We are increasingly spending the future, the far future.

Regarding the bubble-economy we are in:

- It is in an asset bubble where all investment classes and markets are artificially high.

- It is driven mainly by over-indebted, aging, slowing, and essentially Western/Asian economies.

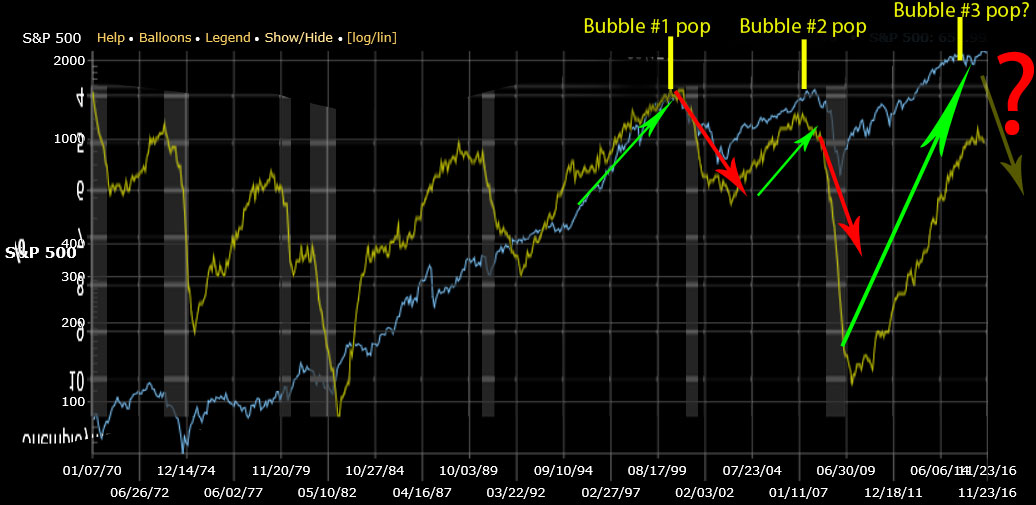

- What seems to be separate bubbles is actually a compounding of 3 bubbles in the last 20+ years.

- But this is just the end on a much longer history of slow and predictable decline.

- The bubbles may last several economic cycles, depending on the action of markets, regulators, and consumer trust.

BUBBLECONOMY: GLOBAL COGNITIVE DISSONANCE

Now, it’s easy to say that I may be wrong, but if in the unlikely even that I’m right…I’d pay attention to more of the problems I am seeing mount.

I really just need about an hour of your time to begin to convince you that:

- We are on the edge of a massive bubble in America (and the world) that will suck in our economy unless there is yet another magical rescue tool, like universe-size “helicopter money” but I will show you that we are out of any rational tools for the most part.

- Simple, and hard-to-deny evidence that unemployment levels are about to sky-rocket (again) even though our govt/fed/banking system is telling us the economy is “healthy”. Now, our govt likes to tell us whatever sounds good and gets them votes, so I shouldn’t expect them to tell us the truth I guess, so whether this is sheer blindness or a grand lie from the govt. I don’t know.

- America is teetering on the edge of bankruptcy and all issues that you are seeing in this country are the result of the bankruptcy. Like a couple going through a divorce over money problems, many segments of this country are divorcing themselves at this moment and it will escalate as the bankruptcy accelerates.

This article may be the most important thing you will read in decades regarding your way of life. It will teach you about the last 20 years of recessions and financial turmoil we’ve seen, and the cause of the next that is just about here. It will help you prepare for it.

And even if it sounds dull and technical (unfortunately, I write that way) the results of what I predict are coming will profoundly change the lives of many in this country.

So I want this article to be understood by most people, but I will talk about a fair amount of new concepts, some of them a bit deep, so if a particular concept is hard to understand, just skip over it, look it up online, or let me know (since I pretty much failed at English). I also had a basic Economics class in college, but that is as far as my education goes on this.

Sure, But How Could the Government & Mainstream News Be Wrong? Don’t They Know So Much More than Me, a Clueless Nobody?

If you trust the govt to know anything about what’s about to happen, might I remind you that even Alan Greenspan, the very head of the Federal Reserve said after the housing bubble popped:

“everybody missed it: Academia, the Federal Reserve, all regulators.”

Everyone? Really? How is it that the smartest PhD’s in the world, the entire government, the banking sector, and the citizens simply did not see something so obvious:

- that when you spend more than you make, you always end up broke,

- and that when you try to bury problems under a rug, it doesn’t make them go away?

- that when everyone lies, cheat, and is greedy, then everyone loses in the end?

Well, another bubble is about to pop, and its much bigger than before because it was simply sweeping the last couple bubbles (e.g. housing bubble) under a bigger rug; and not just the U.S. I call this the “bubbleconomy” because it has been going on for so long. And unlike the last two, this one seems to be unstoppable, unless someone can bail out our govt (possible I guess), so we will finally hit rock bottom. Unfortunately, it’s like a black hole and its gravity is intense, and in fact, the much of the first world is in the same trap. The problem is also not limited to a single issue, but a basket of them which I will cover in this series.

Very few people saw the 2008 housing last bubble ahead of time, as well as the dotcom bubble of 2001, but now you, can see how they were simply rolled up into a mega-bubble once you read this post.

If you disagree with this analysis, I ask that you simply focus on the biggest picture data you can find, along with some basic common sense. I welcome your feedback.

Here is my basic premise for looking at all economic problems, which was not taught to me in college (Keynesian only focuses on creating debt to solve problems):

‘When you spend more money than you make, you eventually run out’ and the United States (along with much of the world) is flat out broke”

Now, in this whole analysis, I may be wrong, but if I am right, you need to read the rest of this blog, because one thing that repeats in history: desperate times (bankruptcy) call for desperate measures (aggressive measures to stop it), and we are approaching desperate times. The next few posts will show the desperate measures we are already in, and not sure how much more desperate we will get. I will also show the problems that politics as well as the dollar faces.

Now, I am not sure why economists/govt don’t see how big the current problem is, but hey, it’s been said that even monkeys throwing darts at a dartboard can beat financial advisers. Maybe it’s due to group think, maybe its like a monkey with his hand in a monkey trap, or trailing down infinitely meaningless rabbit-holes of data while losing track of the big picture.

The financial myths we have lived in for so many years that we cannot yet see. This is cognitive dissonance, and like all economic imbalances, it will eventually resolve itself once markets become rational.

THIS STOCK MARKET PILLAR #1 PIECE IS JUST ONE PIECE OF A MUCH BIGGER PROBLEM, SO SIGN UP FOR MORE

OVERVIEW

The point of this article will show FIVE things:

- EVIDENCE: of the bubble and looming crash

- TIMING: of the crash

- SIZE: of the crash

- AVOIDING: the crash?

- SURVIVING: the crash

But before I do let me explain how this is unique:

- While lots of people claim various timing, I can show you quite clearly where we are in this bubble cycle. This is why this article is truly unique over anything else you may have read.

- We are in the third of three big bubbles, each larger than the previous, each created by the attempts to prevent the previous bubble from popping, so when it pops, it’s going to be epic. This is the bubble of all bubbles, and I will explain why.

- Both previous two bubbles (Dotcom bubble and housing bubble) coincided with the largest stock market crashes in recent history, and also coincided perfectly with the last two major recessions.

1. EVIDENCE: OF THE BUBBLECONOMY & LOOMING CRASH:

The dotcom bubble: “By 2002, 100 million individual investors had lost $5 trillion in the stock market.” – McCullough

The dotcom bubble was likely to cause a depression, so the Fed decided that to rescue the economy, they would make cheaper money, to make housing affordable. Where did that lead?

Housing bubble: 6 trillion was lost on housing, but $19 trillion when stocks, loss in retirement funds, etc… are counted, according to the Treasury Department.

Of course, the govt. couldnt let a depression happen, so this time they moved the bailout up to banks and business. They simply took the bad loans (toxic assets) from the banks, and put them on their own books, because you know, the government will always be solvent.

Government level bubble: This is where we are now, and the next recession will be telling. Question is, when the govt cannot pay back their loans, who will bail them out?

Likewise:

- What happens if you try to bail out the collapse of a bubble, with an even bigger “tool”? Does this increase existential risk?

- Should we assume that the problem will just go away, or will it simply exacerbate it over time?

- What happens when you run out of “tools”?

Originally, the data showed we were at a peak, but them we got someone into office that represented confidence, and clearly the markets turned upwards again on Nov 2016, but the general asset crash cycle still holds true:

The pattern is pretty simple:

- Bubble reaches peak, then pops

- Stock market crash

- Employment crash (recession)

I am not sure what events will happen, from as benign as a sunken ship (causing the panic of 1859) to citizen unrest like Occupy Wall Street which began to spread like wild fire in 2008, or, perhaps something unexpected like anti-president riots.

The real challenge to preventing the increasingly large risk is enough people realizing that we are in a bubble, and until that happens, the bubble wont pop. Asset bubbles, based on confidence, will continue to grow, and remember, the bigger they are, the harder they fall.

Oh, and by the way, the single largest asset on the govt’s books are student loans, and that is according to the Treasury, who also admits our current path is very unsustainable. So if student loans are increasingly risky, and many people simply want them to be written off, what marketable assets does the govt have?

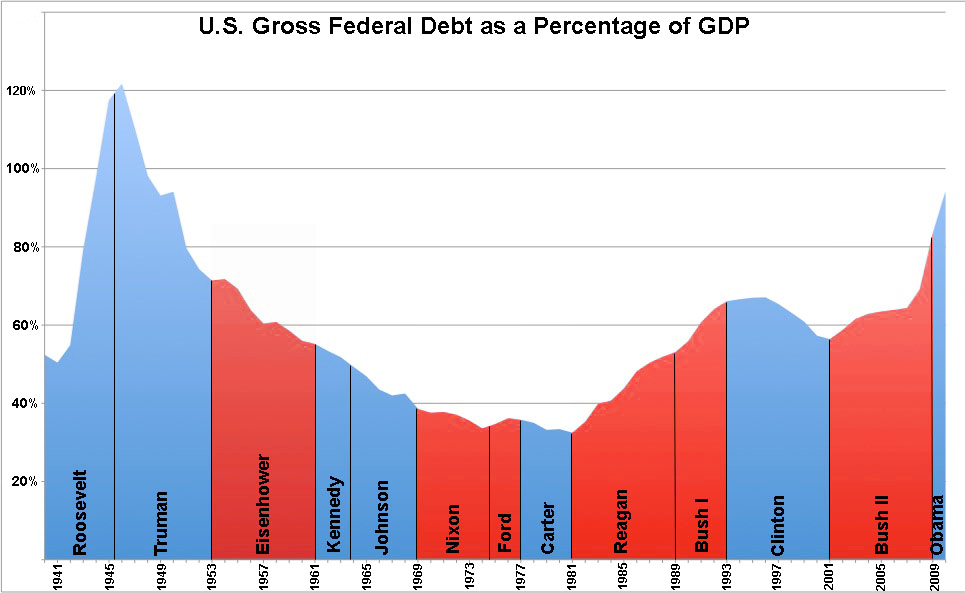

Not Caused by a Single Political Party

Take for example the myth that one political party is more responsible with regards to govt spending:

So Obama had nothing to do with the job recovery when you look at the employment cycle, and Trump will have nothing to do with it either, yet I suspect that is not what will be proclaimed.

It is equally important to understand what caused these peaks and valleys: A collapse of a bubble, followed by attempts to salvage the negative effects it with a new tool, will likely just make a bigger bubble.

Feel free to skim around this article, but bubble #3 has not happened, so might be worth reading at least my predictive outlook on it.

BUBBLE #1

2001

Dot-com bubble

See, back in 2001 we had this thing call the dotcom bubble. Investors bought companies (expenses) which had no income (revenue) and when they realized this exaggeration (Marc Cuban and Mr. Wonderful were convenient benefactors of this bubble by the way) the bubble popped.

Pets.com is one well known example as , which had intended to become an online pet products retailer, was losing money before it went public and raised billions of dollars.

The cognitive dissonance, a.k.a. bubble, was resolved as the stock market crashed, which led to a recession.

But instead of letting it crash down to the bottom where it should have gone, the Federal Reserve decided to try to stop it, to prop it up.

How bad was the bubble? The entire collective set of internet startups had what was referred to in investing terms as a 200:1 P/E (price/earnings ratio), which simply meant that investors hoped that if they invested a dollar, then they would expect to get back $200 eventually for that $1 investment. It’s kind of like the income/expense thing I explained earlier. True, some individual technology companies have done very well, but as a whole, a 200x that is asking a bit much. Comparatively, the average P/E ratio since the 1870’s of the Dow has been about 15.

If you look at the chart above, you can see the bubble, but if you focused on the second largest stock exchange in the world, the NASDAQ, which is basically technology companies, you can see how dramatic this bubble was.

Funny thing is, lots of tech is probably going through a second tech bubble today, which I highly agree with (we are in an “everything bubble” actually). If you overlay the Nasdaq with the S&P500/Dow Jones, you’ll see the peaks align nicely.

BUBBLE #2

2008

Housing bubble

How do you stop the dot-com bubble from causing a full-blown depression? Simple, do what the Federal Reserve did: “Stimulate” the economy by making home ownership affordable, by making cheap home loans.

They “rescued” the bubble by making an even larger bubble, which we now know as the housing bubble.

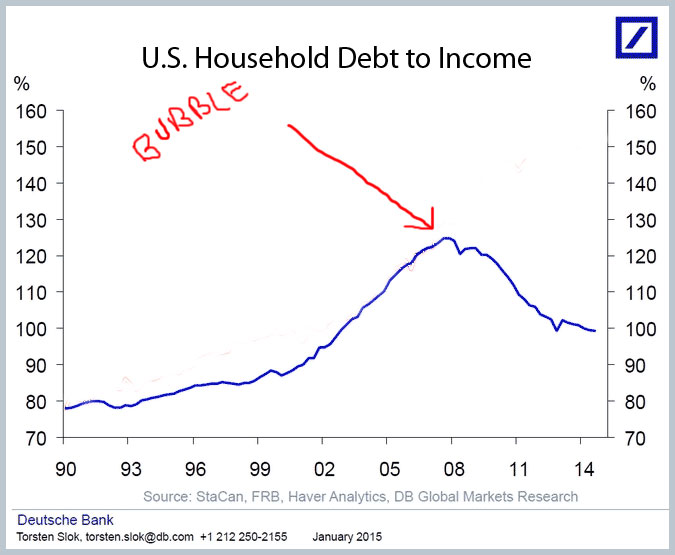

Do you recall how that plan panned out 7 years later in 2008? But making loans cheap to try to grease the wheels of the economy, and eventually they just made a second bubble.

What they didn’t understand is that the problems in this country and the markets were much bigger–they were systemic problems, such as: the stock market will simply not grow at 7% forever (population aging, slowing, technology deflation, etc…).

If you want to learn more about this bubble, the “House of Cards” documentary on NBC shows this whole process of the bubble, and the greed involved.

Here is a simple chart that shows the obvious bubble. Again, when people spend more than they make, when their debt exceeds their income, much of it in housing, what do you think happens? On the left is how much Americans were making, on the bottom is the year, and so you can see by 2008, Americans were spending way more than their income allowed. This one chart tells you everything about the housing bubble.

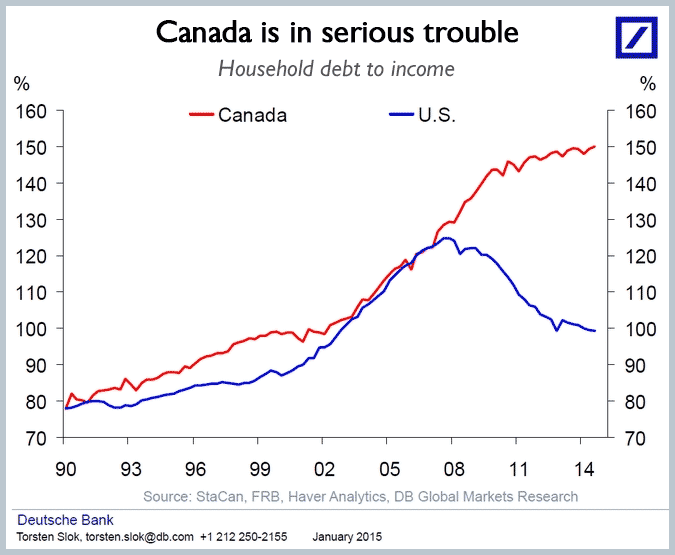

While I am on the subject of bubbles, notice that Canada’s hosing bubble started to form at the same time as ours, but theirs still hasn’t popped (well, I believe it may have started a couple months ago).

Many countries, and large metros like Manhattan/New York, London, Vancouver, etc… have this same bubble currently. Lots of speculation, black market money (1, 2, ), etc…

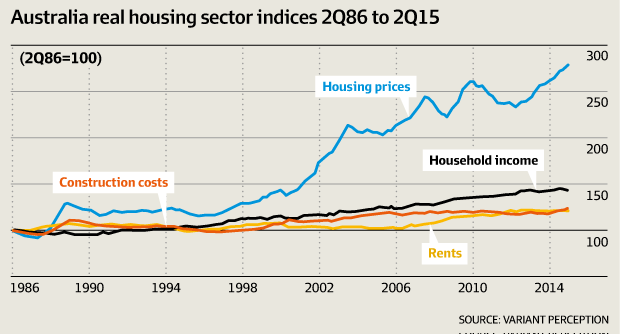

Here is another one; Australia

I’m not going to bore with with more charts, like China’s housing bubble, and other countries, but there is somewhat of a global housing bubble, and when it crashes, of which Vancouver seems that it may have just started it a couple months ago, it’s likely to compound with our stock market issues; I tend to think US housing prices are inflated again too.

Just a reminder, that it is not the home price alone that matters, but the home price COMPARED to what people are making. Debt vs income.

So when this housing bubble crashed, what did the govt do next? Something worse. They started printing trillions of dollars, and the systemic problems have not gone away…

BUBBLE #3

2016 or later

Government level bubble of printing money to buy the bad debt leftover from the wake of the housing bubble

Okay, so when the housing bubble popped, do you realize that the govt went to “rescue” our economy from crashing again? Do you realize that they simply made yet a bigger bubble? a govt level bubble.

So, the government “rescued” us from this 2008 depression via worthless bank bailouts if you recall, which was mainly buying all these bad home loans from the pop of the housing bubble, and they can do that because, well, they are the govt and so there is no risk for them to buy ALL of bad home loan investments, right? They accomplished this by printing trillions of dollars, then bought up the bad loans while hiding them, and then locked up the payments for these bad debts in banks. And there you go: Govt magic. Bad debt and lots of printing of money to buy it does not matter to anyone right? That’s what they, and many economists think.

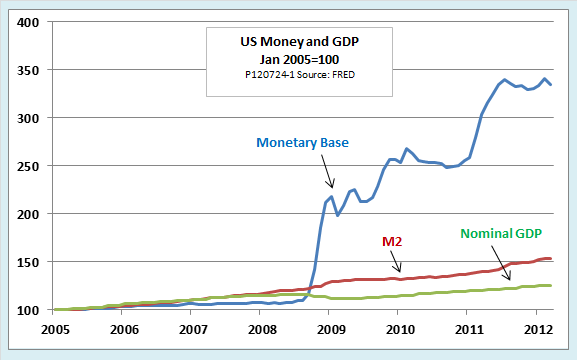

Let’s see if we can see this final bubble. Here is a chart that shows how much money they have printed in relation to our GDP (again, GDP = income of the entire USA).

If anything, this may cause inflation which I will talk about later, but inflation tends to only hurt certain segments of the population.

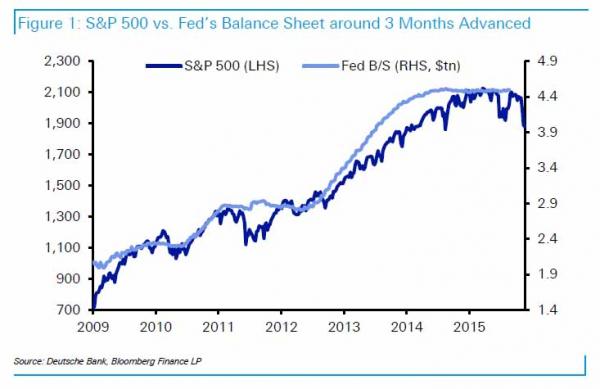

Where are we seeing the effects of this money printing bubble? Oddly enough, it’s in the stock market (and many other assets). How much of a bubble is the stock market in? That I am not sure, but to say its 2x where it should be is probably not unrealistic. Here is a nice chart showing how close the money printing presses growth match the stock market growth since 2009 (S&P500):

If the QE stops permanently, we should see the recession/crash to move quicker. If QE resumes, then later.

Now, we self-interested Americans may believe that the govt buying all the bad housing debt with printed (not earned) money is not a bad idea, but somehow I do not think other countries that lend money to us will agree. For example, if the USA owes China $100 (via U.S. Treasuries) and the USA only has $50 on hand, but then just decides to print the remaining $50 without that actually being generated by real business, do you think China will accept this as a way to pay off the debt?

Of course not. We call this printing of money inflation. Your dollars will eventually buy half as much as they used to, or in other words, prices on everything go up. It is a burger costs $4 now instead of $2. But this is ideal for debtors too to pay off debt faster. Inflation was designed to stop rich people from hoarding cash, which makes no sense because they can simply buy assets, like land, instead of holding dollars.

So anyone holding U.S. Treasuries or cash savings just lost money. You loaned a dollar, and got paid back $0.50. You had a dollar saved, and now it only buys $0.50. That is a terrible investment. Maybe we can assume that this is one of the reasons foreign countries have already started dumping treasuries in the last year or two (More in Pillar #2).

Otherwise, inflation is not as bad as it sounds for working people, but it is a problem for people with fixed income (retired people) or have savings, however, if it’s rapid, it historically has made economies unpredictable and volatile.

Interestingly, as a way to fix inflation, many governments have foolishly tried to print even more money to fix the economic problems that accompany it, which simply drives inflation even higher because not only are there more dollars in the system that buy the same amount of goods, but because people lose faith in their currency as being a reliable “store of value.” So the easy, yet hard, answers are either to let it resolve and risk further economic crashing, or create a redistribution of wealth (advance socialism/communism), neither of which solution is pretty.

So the govt and banks have taken all this risk, and while we are on the topic of banks…

WARNING: The Bank Dominoes of 2008 Never Went Away

I will do a completely separate post on this, but just for a moment since it’s just as important to the bubbles I am talking about, in 2008, when the largest banks started to fail, like Bear Stearns and Lehman Brothers, everyone knew that without the immediate bailouts, that the banking system was about to collapse like a bunch of dominoes (due to so much leverage, derivatives, bad loans, and connected-ness to each other that creates systemic risk). Let’s also not forget how it starting sucking in the largest of insurance companies too (AIG).

Can I ask you a question? Did those bank risks ever just go away, or did we simply forget about them? Could the risks be even larger today? Do you watch banking news? It’s not looking good. Is the largest investment bank in Europe, Deutsche bank, now the greatest cause of systemic risk? The derivatives market is creating the possible collapse of this bank, not to mention all the other scandals it’s been involved with lately.

But how did we, the government / Federal Reserve, actually carry out the current government sponsored mega-bubble?

They use confusing terms perhaps in hopes that regular people don’t catch on to their game: “quantitative easing”, or QE for short, which is simply to print lots and lots of dollar bills, and buy all these trashy, worthless home loans, then lock this money up in banks so that we don’t get weird side effects, like rampant inflation.

Quantitative easing, or maybe we should just call it “printing money and hiding it in banks” seemed like a great idea at first, and seems to be an extreme opposite course that the Fed took in the 30’s, which actually caused the depression, not free markets, according to Milton Friedman, the most respected economist in the last 50 years:

Economists have come to understand the Great Depression as a “perfect storm” of policy failures. A truly frightening number of destructive policies were carried out nearly simultaneously. In retrospect it seems as though whenever the economy began showing the slightest inkling of recovery, a policy would be enacted that would put a quick stop to it. The better explanation of the Great Depression revealed it was not caused by unfettered market forces. There is nothing in the operation of free markets that would create depressions or even recessions. Rather, we now know that we must look for causes of these phenomena in mismanaged and erroneous government policies

Even the current Fed recognizes this truth. Ben Bernake, former head of Fed said in 2002:

I would like to say to Milton and Anna: Regarding the Great Depression, you’re right. We did it. We’re very sorry.

Funny that hindisght is 20/20. I wonder if a room full of phd economists today are just as smart as those in the 30’s. Let’s look at QE for a minute, the grand solution by modern economists to modern problems. Let’s ask the govt themselves; QE is not working to stimulate the economy.

But let me ask you a more important question: Do you think the QE dollars and bad housing debt sit hidden on govt balance sheets forever? Funny thing about economics is, on a small level, federal reserve interventions can indeed help, but in the long run, when you mess with it enough at increasingly bigger levels, it tends to grossly magnify and compound previous problems. Unfortunately, I find that creativity tends to be more effective in art than in economic problem solving.

And if history is a better predictor of the future than a few smart govt economists in a room, chances are, all this printing of money isn’t going to end well once it escapes the banks. Eventually, those dollars in the banks will probably have to sneak out somehow. but maybe it will take 20 years which would not cause problems on traditional inflation timeline, but I dont see any escape plans in place yet. The point is this:

What Started as a Small Market Bubble Has Grown Into a Massive Govt Level Bubble

- Small Dotcom bubble –> rescued only to become housing bubble

- Medium housing bubble –> rescue by more massive government bubble.

- Govt bubble –> What is the rescue plan? print more money? Who will bail out the government itself?! I’ll discuss options later.

When this next bubble pops, and the govt. wants to “rescue the economy” again like the last few times. Even news and financial sites constantly try to tell us unlimited govt debt is safe, because they are the govt. but I disagree because no one is immune to bankruptcy, not even govt.

How Will the Government Bail Itself Out, or Will the World Try to Bail Our Govt?

Regular people like you and I don’t think about all this bad debt, because most of us don’t lend to the US govt. It’s when other creditor countries decide we are no longer good on our loans to them because we have tons of bad debt on the books, and have tried to print more and more money to swim our way out of our problems.

Compound that with a crashed economy and it’s likely we will be seen as insolvent. Again, high debt, no income. Will foreign countries keep lending to us? What would any reasonable lender do? If we default, will we ever have good credit again? The world is afraid to let go of the dollar, but at some point, it may happen unless our govt dramatically re-balances its budgets, existing debt is paid off, even if with assets, etc…

Some of you understand that the USA dollar has always been the refuge in times of economic uncertainty; that when the stock market crashes, everyone, incl other countries tend to invest even more in the dollar, which is their way of saying, they trust we have a strong economy, the strongest in the world, and when even the world economy is on the edge, we are the cleanest shirt in the dirty laundry. Well, if our economy is flat, meaning no income, and extreme debt, at what point do they say: The United States of America is broke, and then find some other country to invest in; one with low debt, and strong income? Could we lose “hegemony”?

But I will cover more of this in Pillar #2. In the meantime a little recap with all points:

- Dotcom bubble –> Stock market crash –> Recession

- Bailed out by housing bubble–> Stock market crash –> recession

- Bailed out by govt/banks/printing money –> stock market crash (imminent) –> recession (imminent)

We are in an “everything bubble” at the moment where all assets are inflated:

- stock market,

- real estate (globally and locally again),

- farmland,

- bonds

- commodities / oil (which have already started popping).

- the second dot-com bubble

- Alternative currencies may or may not be (foreign / metals):

- “Mr. Greenspan said gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments” – New York Times

2. TIMING: OF THE CRASH

Nobody knows, because gaining confidence of an entire society is impossible to predict. But it is not “if” but “when”.

3. SIZE OF THE CRASH

Probably very massive because if you figured it out already, we are not in a 7 year bubble, but because instead of letting the economy crash, we are in at least a 15-20+ year, government sponsored level, bubble, and such the dollar is the world’s reserve currency, other larger effects will compound.

50% or More Decline:

I look at a lot of data, but at a minimum we will probably see a decline in the Dow of about 50% over the next crash, which would not be surprising if you look the previous downturns, but because this cycle may fall to its natural bottom, that could get a lot worse. If the recession deepens, then pulling out of a nosedive will be hard to do anytime soon.

International Effects:

What happens when the largest powerhouse economy, the engine of the world, which exists within a highly interconnected world, goes down? What happened last time (hint 1930s)? What happens when you understand that many other first world countries are in the exact same boats of crazy debt, fake growth, and little chance of paying all this debt off?

- China: isn’t faring much better with its fake stimulus and hundreds of govt sponsored ghost cities (a.k.a. “growth”) which is the idea that if you create supply, then demand will follow, which is absolute opposite of free-market principles (1, 2, 3 ). Perhaps they will fill up, time will tell, but probably not in the current global situation.

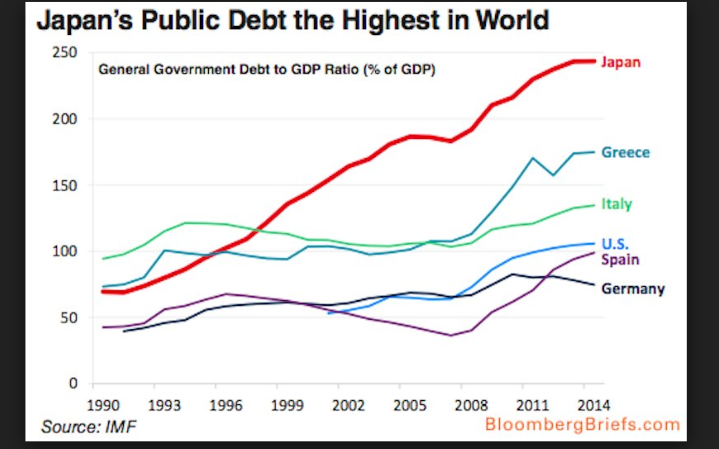

- Japan: has govt. debt to the moon, more than any other country

- Greece/Europe: Europe is debt-ridden (remember that chart above?) while Greece threatens to suck them all in in this globally-interdependent world. In fact the Brexit may be a real trigger in all this; in that same NYT piece I quoted earlier, Greenspan “was also downbeat about Europe and said the only way the euro can survive over the long run is through full political integration of the 18-country area that shares the currency. Anything short of that will allow imbalances to fester and build, eventually leading to a collapse of the currency, he said.” – Well, the Brexit probably cracked that egg, but it was doomed anyways, as I have alluded to earlier that globalism is like mono-culture: it is rarely the cure-all; it is more like leverage.

- Russia: Banks around the world, like Russia, are frequently on the edge of meltdowns and bankruptcy.

- Argentina: Realize that the whole world is dependent on our massive economies, and Argentina’s money issues from their bankruptcy: inflation, rampant corruption, theft, looting, Presidential turnover, etc… in the last few years in Argentine will probably look like child’s play since the US alone is 14x the size of Argentina’s economy. Seriously, you should read that article, as well as other books on bankrupt countries if you have time.

This is all easily seen by looking again, at income versus expenses countries. The world wants to believe that somehow, governments debt doesn’t matter, esp. because every other country is engaged in the same practice, but it may be the citizens that collectively disagree with these practices in the end. Perhaps even Africa is starting to look like a relatively nice place to live here in the near future.

Income vs expenses. Imagine that. So what happens when a country continues to spend more than it makes? Duh. Let’s talk about these for a minute, because education is important:

- INCOME: This is called Gross Domestic Product (GDP), which means what a country makes as a whole

- EXPENSES: You could simply look at personal and govt debt. Both are out of control. In fact, if you just look at govt debt, you can see all the Western countries that it’s happening to.

Can we see something that shows income vs expenses for countries?

While this chart has some issues, the general trend is pretty clear: Western countries and some others are the ones at most risk of a default.

If you have followed the world news much over the last few years, it should also be pretty clear why Greece’s financial situation is scary, because if it breaks out, all of Europe will be broke–Contagion. Systemic risk. Just like the banks too. If Greece goes down, they start to suck in all of Europe.

Generally speaking, inter-dependence on a global scale (globalism?), esp. when multiplied by things like financial leverage, become a giant pool of shared risk: when things are good, they are good, but when they are bad, they are really bad. The bigger they are, the more elaborate the intertwining, the longer the chains…the more fragile and destructive power they hold.

The Western/first world as a whole is seriously underwater, and their creditors are on the line. Personal debt is a huge part of the problem I imagine as well, but I will leave that for another day.

In short, we have spent the future.

I don’t understand all the steps that could take place here in the near future, but we will see some rapid transitions of wealth between rich and poor, the hedge funds, the speculators, the rational who understand value.

We can be almost sure that we will see the 70’s repeat which was rapid inflation and high unemployment; we called this “stagflation” and until the 70’s economists thought it couldn’t happen until it did.

We will probably see see rapid deflation first, which means a decline in prices (all the bubbles start popping), which is what we saw last year already with the oil crash. Again, although its hard to predict where the volatility will move to next, perhaps we will see slow, or perhaps rapid inflation, which is what happened in Weimar Germany in the 30’s just before WW2.

We could see the investments (asset bubbles) of the rich wiped out, and power automatically readjust in favor of the poorer classes. In other words, things will reset themselves nicely. We could also see luxuries become worthless, and basic needs go up when there is a squeeze on these things.

I could provide some more charts that show this same strong correlation with govt money printing, but will try to add it later. Printing more money creates more speculation, meaning a larger bubble.We are in an everything bubble at the moment where all assets are inflated: stock market, real estate (again), farmland, bonds, and commodities (which are popping a bit).

4. AVOIDING: THE CRASH

Overall the power of black holes of this size are hard to get out of. Here are a few reasons why.

Accelerating unemployment:

Again, if you recall, the policies of the govt. In the last 15 years have always been there to stop the recession from getting REALLY bad. They talked about how it would become a depression if they didnt rescue the economy with printing money.

If we are not rescued from this next bubble, it will likely be much worse than in 2008 because this time, the economy and unemployment may be unstoppable to sink to where it would have hit decades ago, so now because of bubble size, the risk is much greater.

Again, who will bail out the government? that is the only question I think about this time around.

The USA has no other reasonable/obvious alternatives to preventing the next crash. I dont’ want to discuss these in depth here, but note that none of these will permanently fix the fact we are broke. I’ll cover the more likely options first.

Most options involve either things citizens will find irrational, or, increasingly socialistic/communistic/nationalistic.

- Negative interest rates:

This mumbo-jumbo term is new to many of you, but do not fear. It simple. You know that over the last several years, banks have kept lowering interest rates, like on your savings accounts, to just about 0. This is the result of the govt/federal reserve (same thing in my opinion) continually thinking, if interest rates go lower, then the economy should pick up as people borrow more money. Well, there is nothing lower than 0% interest right? Wrong says our delusional governments. We can go negative! We can charge people to borrow money from them. When you buy a U.S. Savings Bond, the govt/ can charge you, instead of you charging them. Doesn’t that make sense to you?

Paying someone to borrow money from you. So, at what interest rate do citizens begin to realize that the cost of keeping money under a mattress, or other alternatives, is cheaper than keeping it in a bank. Crazy talk you say? No, many countries incl. Japan, Sweden, Denmark, Switzerland, France, Germany, Italy have already started this, and the US Federal Reserve has recently said they would not, but well…we’ll see how that pans out here, but consumer confidence is waning already. At least for now, it’s mostly just govt buying these from other govt’s, but the total is already at $11 trillion. More proof of the govt drinking its own Koolaid. You can learn more here

- Helicopter money / More intense levels of govt printing more money (more quantitative easing):

Again, creditors, or people our govt owes money to, aren’t going to put up with this because its stealing from them. If we owe China a billion dollars, and we print those dollars to pay them, is that going to solve anything? Will China keep lending to us, or will they start to take back those loans (more in pillar #2). That’s hard to say because China is playing the same game as us with their govt. spending that is creating ghost cities. Talk about waste.

Perhaps you have heard the radical proposal “helicopter money” which means to simply start giving citizens money in hopes they spend it and cause the moderate inflation. Well, few can agree on that either, but of course, just put yourself in the shoes of whoever holds govt debt, or a foreign nation that does not have the luxury of handing wealth to its citizens, unless they start the same shenanigans. Again, other countries besides our own are considering this as well like Japan.

- Max-taxation of the rich:

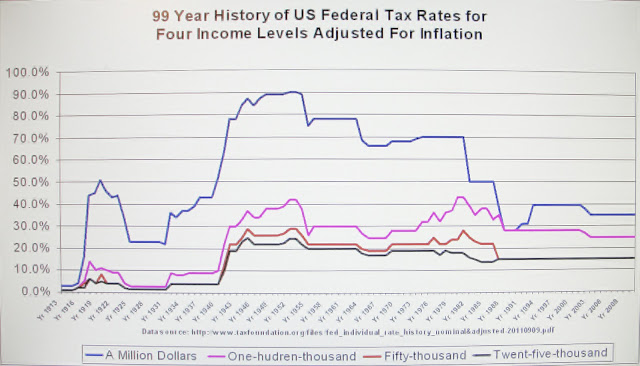

Intensely high income taxation on the rich, which actually has been done such as post WW2 where taxes reached 90%+ for the rich class (see below), although some argue that the net collection rate has always been about 30% regardless. This is probably the most likely scenario with the least lash-back by the masses. In fact the masses will probably shout for joy on this socialistic money grab, but be warned, we are all subject to such grabs depending on where the lines are drawn.It has happened before. Notice the income tax rate (90%?) on the millionaire earners during WW2 times. But there is a good chance that like Atlas Shrugged, those people will simply begin to leave the country faster than they are already, so not an ideal fix today’s world.

- Govt stealing (a.k.a. nationalization) of wealth:

Such as pension funds. Russia, Argentina, and others, and Poland have already done this in attempts to stop the govt bleeding or perhaps we should safely declare is bankruptcy = in the name of “safety” but let me ask you. At what point is safety from collapse, due to poor govt planning/spending, really become theft/communism as the govt robs private property from its citizens.

- Should we think this is a good thing, is there anyone in this country that believes the country knows how to manage money? They’ll probably just waste that too. Even think how irresponsible the govt has been with our existing savings: social security (which is almost empty as the SSA admits themselves, due to poor planning, and will either require higher taxes, or less benefits for seniors, working longer; but will probably be emptied sooner if our economy sits dead in the water long enough).

- Or outright stealing/locking-up of your savings like Greece

How do you steal from your citizens? Step #1: make sure you know where ALL of your citizens money is hidden. How? The recent draconian banking measures called FATCA, which few of you probably know about. FATCA now has knowledge of (and therefore logically the ability to tax) every law abiding American citizen’s bank account around the world, in the name of “catching bad guys” or the tax evaders. Did it work? Reports shows they spent 1 trillion dollars to collect $15 Billion, which means its 99% waste, so how do they justify a wasteful program such as this? FATCA doesn’t sound very comforting to all the responsible, tax-paying citizens that want to diversify risk away from their own govt.

Perhaps it’s just one more step in the big list of the citizens and governments fear the nearing bankruptcy, so both sides attempts to pull harder apart from each other. The interesting thing about FATCA is it actually fulfills a major step in “financial repression” if you’ve read the history of that; which is in essence, a way for govt to collect more money to solve debt crisis by silently de-empowering its citizens.The reason financial repression seems unlikely escape mechanism like post ww2 is because private debt is high and savings are low, meaning there is no money to rob from citizens this time.

- Govt stealing (a.k.a. nationalization) of private property:

Yes, there is even a little known Presidential contingency for that too. In times of “national emergency” however that is legally or loosely defined is yet to be determined (financial collapse? war?), there has been an executive order, meaning it just takes the President’s signature without any sort of voting, that has existed since the 70’s when it started under Nixon, and re-signed by most presidents since. Read it on Whitehouse.gov. Essentially in the right circumstances, the President can declare communism as being legal. Now that is truly interesting don’t you think? But in all the countries of the world, Americans are probably the most fearful of communism, so not sure how well this one would go over:

- “Sec. 201. Priorities and Allocations Authorities. (a) The authority of the President conferred by section 101 of the Act, 50 U.S.C. App. 2071, to require acceptance and priority performance of contracts or orders (other than contracts of employment) to promote the national defense over performance of any other contracts or orders, and to allocate materials, services, and facilities as deemed necessary or appropriate to promote the national defense, is delegated to the following agency heads:”

- Global bank bailouts (IMF?):

Bank power could continue to roll up as it has done for the last decade, as many small banks were liquidated in the 2008 crisis, until it reaches just a handful of mega-banks, or even the world’s bank, the IMF. Think about all the banks that are at the edge of another crash. This is probably higher on the list of options actually. This is the hardest to understand because a feat of this scale has never been attempted, but if their involvement with Greece is an indicator, then chances are, they may not have the capacity to rescue the entire Western world. However, with so many banks on the verge of trouble again, I am not sure how this would be feasible; perhaps some research for another day.

- Other?:

A variety of untested and bizarre scenarios could play out. Any ideas here people? I am open if you have ideas that you can leave in the comments below. Argentina may provide you with some good inseights, since most of the above actually happened when Argentina went bankrupt.

- All bubbles will pop in the long run:

Again, if balanced budgets can be achieved, that might help, but no one in office wants to rip off the bandage off our fake economy. It also tends to follow that govt. frequently just makes new problems when trying to fix old ones (unintended consequences). Also, in my next post I will show why bad budgets are likely to accelerate into the next major problem (Pillar #2).

Regardless of the method used, they will still have a hard time rescuing the recession+depression that is clearly on its path. All these types of fixes are just temporary bandages on a gushing artery, and in fact will make the fall that much harder if it is delayed again into once again, a larger bubble.

We can say one thing for sure: As a country, and as citizens, we have all spent far more than we should. I don’t know how much belongs in each bucket, but in short:

- We have robbed the present and the future essentially via the largest govt. “credit cards” in history, which is govt debt as a whole, and bank bailouts.

- As for private debt, our wealth is fake and we spend much of it frivolously and falsely, keeping up with the Jones’.

- We have also funded so many unnecessary, and even some false wars, that have contributed to the problems (more on this in an upcoming Pillar post), but these also add to the bubble situation more than you realize.

- Both entitlements of the less wealthy, and imbalance in wealth, are always a recipe for disaster to any market, free or otherwise.

Why 20 Years Might be an Under-Estimate, and 40 Year Bubble is a Better One.

I mentioned previously that it will be at least the largest in the last 20 years, but when combined with my other research in Pillar #2, this bubble actually started 40 years ago when we the world started running out of faith in the dollar . So how far we sink below today’s levels is hard to say, but once you compound a few other problems that we are facing in this country, and I will discuss in Pillar #2 and #3, it’s not going to be pretty.

Unless we are “magically rescued,” again, we will be much worse than before. So combine a depression, global depression like the 1930’s, + bankrupt countries, and you have the same recipe as we have seen multiple times:

- Pre-Civil war in the Panic of 1859, when the markets crashed due to global inter-connectedness (check), along with over-expansion of the domestic economy (check); along with the US losing a ship with 30,000 lbs of gold (are we out of gold?).

- Again the bubble of the 20’s, followed by the stock market crash, +depression of the 20’s and 30’s, which cause rapid deflation and inflation in many places–something we are likely to see again here soon as things resolve. Although I will argue that the USA looks a lot more like 1930’s Germany.

So, what do you think happens when desperation of many of the globes “first world” countries all run out of money at the same time, because the fact is, they are really in debt to their ears, which in my opinion, is just a slow form of corruption (I’m working on a New Corruption Index already)? Am I out of line for claiming the following?

Global chaos

Two things I dont like and its alarmists and people that dont take risk seriously, so I have a hard time balancing my message. And as I said previously I see that our economic problems are most of the underlying reason for the seemingly unrelated issues our country, a recoil towards isolationism (Brexit, Trump), but won’t be aware of it till next year or the year after.

How will this cognitive dissonance resolve? Use your imagination, but it’s going to be a long road. Even the Civil War was fought over economics, the result of slavery, and power (state rights/voice) (1, 2).

If you think I am exaggerating about today’s issues, the tension is thick as you probably know unless you live under a rock. It’s manifesting itself in many divisions, like a divorce over money problems, or two kids fighting for the same toy. Rate each of these for yourself:

- Race conflict and division: __

- Wealth conflict and division: __

- Global superpower tension and division (e.g. USA vs Russia, China, Iran, etc…): __

- Political tension, division between left & right

- A retreat from globalism including Brexit, other European countries, and in the US: __

- Social media / internet tension, debate and division: __

How did you score on each?

#5. SURVIVING: THE CRASH

#A. Common sense: Food storage and general preparedness:

Few in pre-WW2 Europe imagined that they would soon be trading gold for its same weight in tulip bulbs and potatoes, so why do people think future risk is also unlikely?

Let’s say in best case scenario that unemployment rises to where it should have been years ago at, well, we can only guess: 15%, 20%, 25% (multiply that by 1.5x actually if you include those the President doesnt like to talk about when boasting of himself, U6). In fact, if you count these people, we already had a depression almost comparable to the 30’s in employment terms, but you simply didnt see food lines because we use food stamps today.

I know that normalcy bias prevents us from thinking anything bad could ever happen in this world, but common sense says: Even if the start of America’s financial problems isn’t tomorrow (note that I am suggesting not “if” but “when”), at least you should have some decent food and water storage; recommended 1 year’s worth of food (some churches surprisingly still practice this today in light of the safe world we live in), but seriously, any food storage is better than nothing.

Remember that even in farming economics, the disconnect between producer and consumer can be so high that while people are starving, companies are throwing away food. For example, a relative in my family once said that while merchants in Chicago were trying to sell oranges to people in the Great Depression, they would dump the excess in the bay, and when they saw hungry people going out in boats to retrieve them, the farmers simply pushed them further out to sea, because farmers were going out of business with no customers.

We could end up looking a lot like Venezuela. I list only high-quality/reputable sources for food storage on this site, and if you know more, I will add them. Anything else you can’t live without for a year, such as other supplies and medication are not a bad idea either. Even toilet paper is a black market item in Venezuela now.

#B. Get out of Debt

A second idea is to get out of debt. Quit keeping up with the Jones’. The money that many of you think you have is not only probably more than you need, but it is not real.

We have lived more lavishly than at any time in history as today’s lower class probably have a more comfortable life than the kings of just a few hundred years ago.

Many of us could probably do better with less. We could live below our means and use our excess to help others instead of buying a little bigger home, a littler newer car, one less birthday present.

Beyond that, there may not be a lot you can do to prepare.

True, you could leave the USA, but I don’t know if other countries will be better off, because like I said before, the US IS the main support for the entire global economy. My friend recently jokes about moving to some obscure jungle or island, and that doesnt sound like such a bad idea, if it wasn’t for the fact that most people have family/friends here.

#3 Positive effects on humanity

This future scenario is not as bad as it sounds. If anything, great crisis shape humanity, often in a positive way. I am not a pessimist, in fact, I am super optimistic, but that can still mean a lot of hard work is expected.

After a reset, we may learn the value of work, community, living simply, and many other attributes which I discuss here.

To be continued in Pillar #2: The death of the dollar, loss of hegemony, the end of US being the richest country on earth.