Lets assume productivity is based on three general principles:

- Number of workers

- How hard they work

- How smart they work

This is my basic formula:

Workers x effort x innovation

So if that creates supply of products and services, then what will consume it? Where factors that will cause the shift in the flow of wealth, which I will cover as point #4. Those first two items are in trouble today. The third point is probably more difficult to measure, so I will not address it, however, I do not think kids today are materially smarter than previous generations. Au contrair.

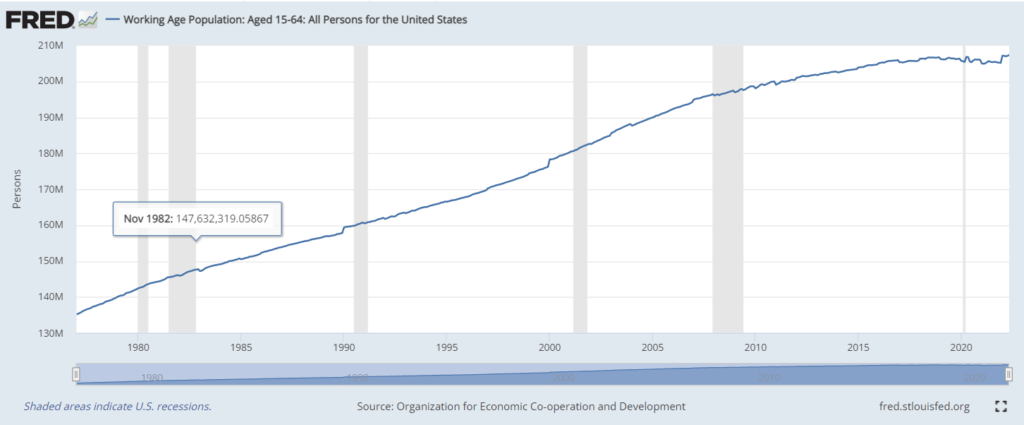

1. The Declining Number of Workers:

Can you see the problem? It’s at least 20 years in the making now. As there is a shortage of workers, companies are more likely to then have to compete for them via with higher wages. This is exactly what we saw last year. Wages of entry level workers jumped to 2x – 4x minimum wages in some areas. Shortage of workers. This is what I expect for the foreseeable future. I am not saying the shortage of workers cause long term inflation, since inflation is ultimately a result of govt printing more money, but in the short term, prices will go up in response to the labor shortage. For all I know, the recent price increases in real estate and materials may be permanent, or it may affect only some classes/categories, but if its permanent and tied to the inflation we are overdue for, then wages could go up to match.

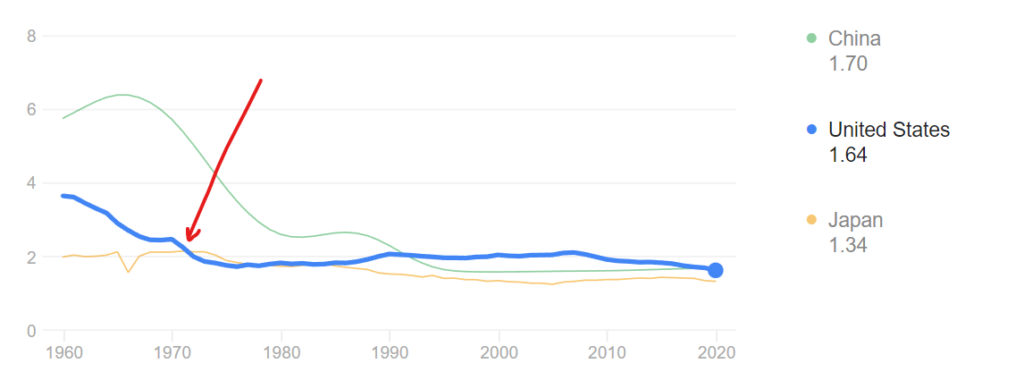

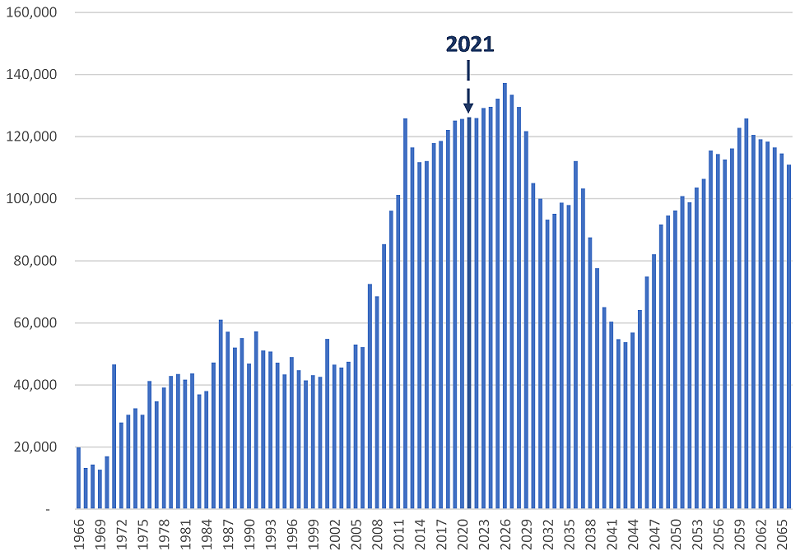

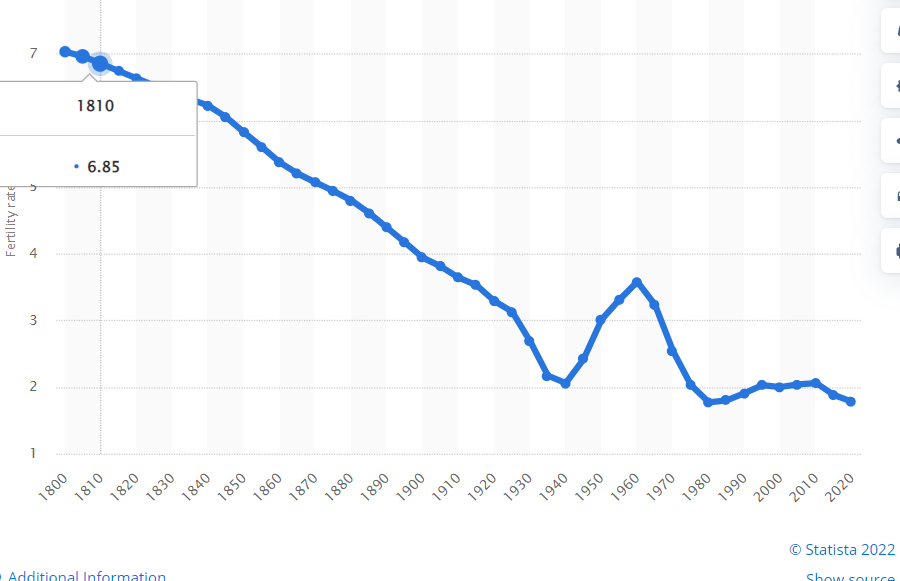

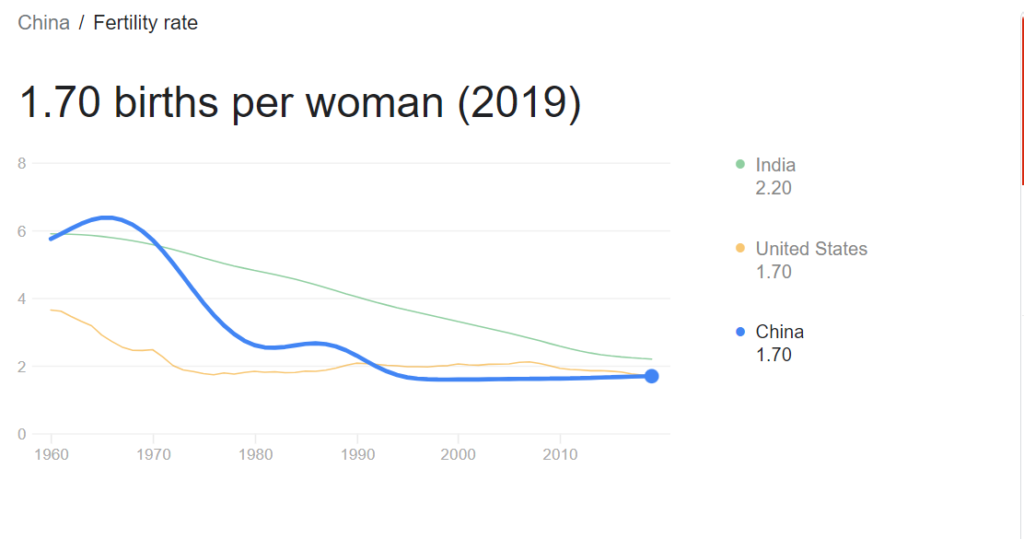

Combination of slowing fertility rates on one end, and baby boomers existing on the other end. Let me show a chart for each. First the baby boomers:

Then fertility rates:

Eventually, the retirees on the front end, and lack of new workers will shift our country to be weighted heavily towards old-age, but I guess that is why it makes sense to have the coming robots take care of old people, right??

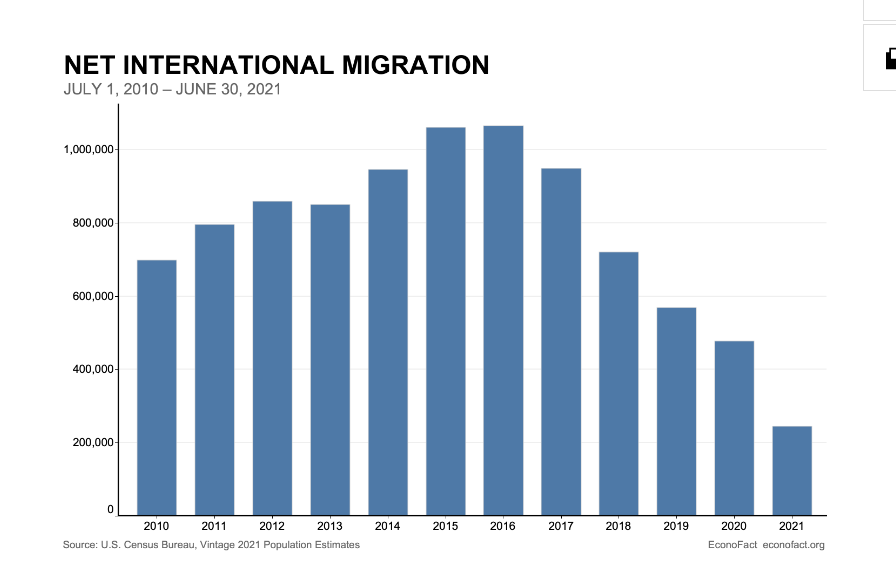

We have been sub-replacement fertility rate since 1980, but since we are the freedom and economic capital of the world, we have immigration right? Immigration rates are slowing too:

2. How Hard the Workers Work

Anecdotally, there is not an employer I have spoken to in the last few years that does not complain about how poorly young workers work. Some of them refuse to hire at all for this reason. This is also true when I surveyed several temp staffing agencies. It is hard to disbelieve because the world has gotten easier than ever to survive with minimal effort, both because life is easier overall, but because of the current success cycle.

4. If there is a shortage of workers, will there be a shortage of services/products?

Does not take a rocket scientist to see that if the richest groups in America are the seniors, then their dollars will simply be competing for products and services of the youth to take care of them, although if social programs for the aging keep ballooning as they have been, then either way, inflation will grow much quicker than it has in the past. The lack of debt and spending practices amongst seniors may also dampen the inflation I expect, but the govt programs will undoubtedly cause inflation in the long term. I am not sure what seniors do with all their money when they die, but that is probably something to be explored further.

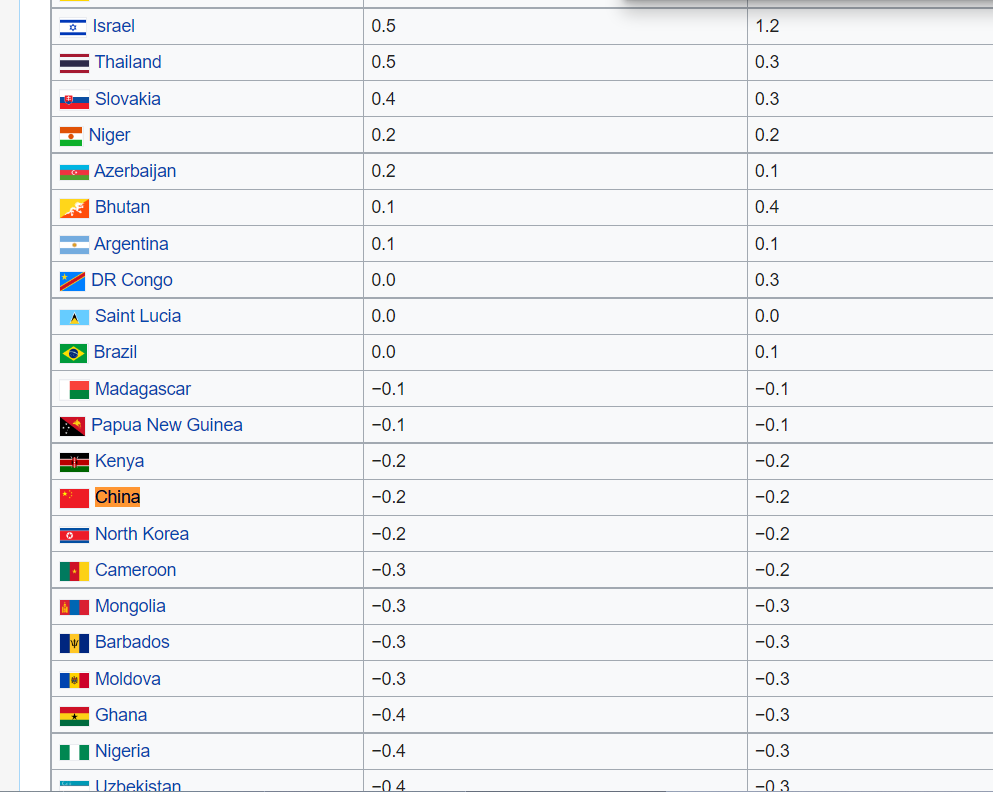

P.S. Is China Competition Demographically Speaking?

On a side note, people point to China as being the next super-power because they have lots more people, but not only do they have a lower fertility rates that they cannot bring back up (women in China do not want more kids to interfere with their comfortable lifestyles)…

…but they have some of the lowest immigration rates in the world, right along side North Korea. People from China come here–our #2 immigrant group is from China today–not the other way around.

Deflation May Be an Even Greater Risk

Now that I said inflation is here to stay, the reality is deflation is a larger long term risk. It will happen at some point.

All central banks in mature (old popultions) countries have been fighting the opposite of inflation for some time, which would be called deflation. It’s being fought by lowering the interest rates. In Europe and other modern places, the interest rates are negative in order to prop up growth. Deflation is an economists worst nightmare because it IS the defining feature of the Great depression.

If lowering the interest rates fail, then deflationary spiral may occur leading to a collapse of the economic system.

Today the risk (potential) is therefore actually higher than the Great Depression because back then, they hadn’t been artificially trying to been trying to fight it off for decades with abnormally risky tools like we have been with artificial inflation targets and super low interest rates.

What are the risks of deflation then and what is it?

Simple: Prices are decreasing over time instead of increasing (inflation). Why is that so bad then? Like the 1930’s what happens is the following:

- As prices drop, it means companies are lowering prices to keep customers buying

- Customers wait to buy because if the price will be lower tomorrow, then why buy today?

- As a result, the economy goes even slower and more companies go out of business while the remaining ones lower prices further, causing a cycle of shoppers to continue to delay purchases.

- It’s like hyper inflation, but in reverse. Instead of people rushing to buy as fast as possible to get rid of cash (hyperinflation), people buy slower and slower

- This means people hoard cash and possibly other forms of money, which is what happened in the depression with gold, which is why it then became illegal to have.

Most economists think inflationary spirals are worse than hyperinflation, even though most destroy money or businesses. Like all spirals, they will end, but it’s impossible to predict when, how large, and how long the effects might remain.

Personally, I do not see how with an aging world, and without another baby boom, how deflation will continue to be fought off because eventually there are no new workers to create that 1% GDP growth target, and most of your workers are no longer of working age. That happened in 2021. I do not think that is going to reverse anytime soon (low immigration, low fertility).

Populations are going over the hill as I wrote elsewhere. China grew at 0% last year and the US was almost as low, mostly perhaps because immigration has decreased by 75% in the last 10 years, and immigration is the only thing that has kept population growing in the US for decades (because fertility rates have been under replacement levels since the 1980’s, seriously)

I call this the most important chart of the year, if not decade or century:

Inflation vs Deflation Battle

So really, the Fed and all central banks around the world are in a delicate battle between inflation and deflation, but I tend to think as time goes on, the potential for either to break out increases as they leverage interest rate behavior (by getting closer to zero. I wont detail why in this post).

You can see for example in 2020 when the Coronoavirus hit that the govt printed a ton of money. I believe 30% by most estimates. It nearly perfectly offset the drop in the velocity of money, which means at that time, everyone just stopped spending, perhaps due to the govt shutting down so many businesses and people not going out so much.

This is exactly how money printing is used today. Money supply x velocity = inflation

So when one drops, increase the other, so in theory, central banks will always find this perfect balance to keep a constant 2% inflation target. Well, I really dont think so, but I do think they are increasing potential risk by collectively (globally) modifying the money supply to get artificial results, so in other words, while they can fight off small bumps, systemic ones will just hurt that much more because small resets were never allowed to happen all along.

What we probably will see then to some degree as well is inflation in critical classes (e.g. food and consumer) and deflation in non-critical (e.g. investment assets and luxury).