I have never seen a chart that shows the overarching goal of central banks’ attempts to smooth the growth of the US economy, combining money supply with the velocity of money. After the charts, there is a detailed explanation as to why banks print money, how they are trying to avoid another Great Depression, the risks of such behavior, etc.

The big lesson for the Federal Reserve and the government from the Great Depression is that when the govt stopped spending money during the crisis, it caused the money supply to shrink, and instead of a small recession, the govt actually the cause of the Great Depression according to Milton Friedman.

Sometime later, Franklin Roosevelt started spending on massive public works like the Hoover Dam, which in turn restarted the economy as few others were willing or able to take large risks in getting the money supply going again (let’s not forget that the stealing of American citizen’s gold and WW2 were massive factors in reversing the depression as well). This was also the first major opportunity for the govt to increase its power base by instituting large-scale social programs such as social security, unemployment, and other items under the New Deal.

John Maynard Keynes also thought that govt spending was the solution to recessions. This is why banks like to print money during recessions. They do not want to repeat the past (contracting the money supply during the crisis). So, the money supply may be the best predictor of short-term future economic growth.

Definitions of “Money Supply” & “Velocity of Money”

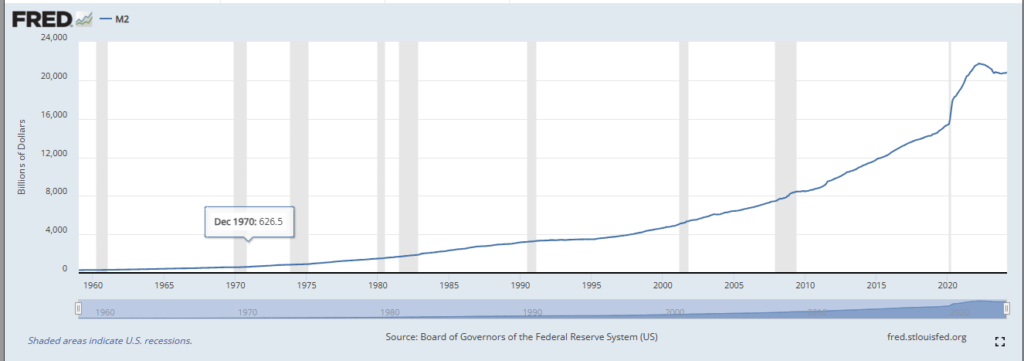

Supply of Money: The amount of money in the system. Typically measured by M2. This amounts to printing money.

Source: M2 (M2SL) | FRED | St. Louis Fed (stlouisfed.org)

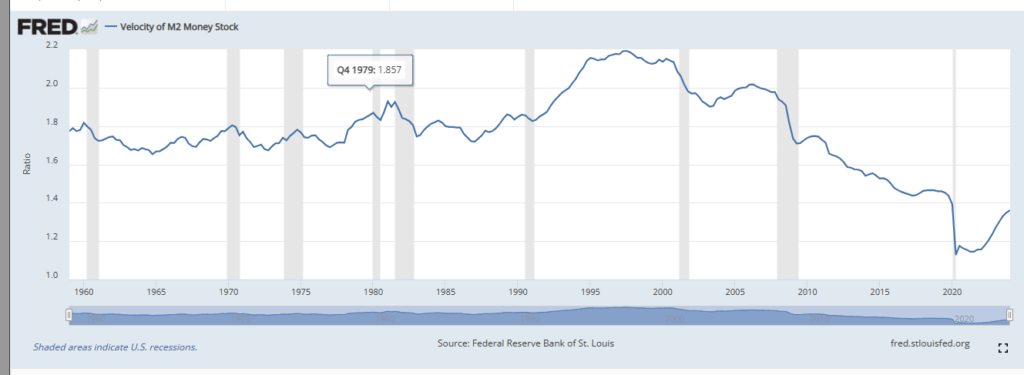

Velocity of Money: The rate at which money is spent in the economy. Really, I prefer the “speed” of money.

In the exact words of the Fed “The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.”

The Relationship Between Money Supply, Velocity, & Inflation.

If people are not spending money, then the economy is crashing. Even if trillions of dollars are printed and released into the wild, there is no inflation happening because there is no shortage of money chasing goods.

If you have ever learned about electricity or water, they follow similar principles. Water needs speed and volume

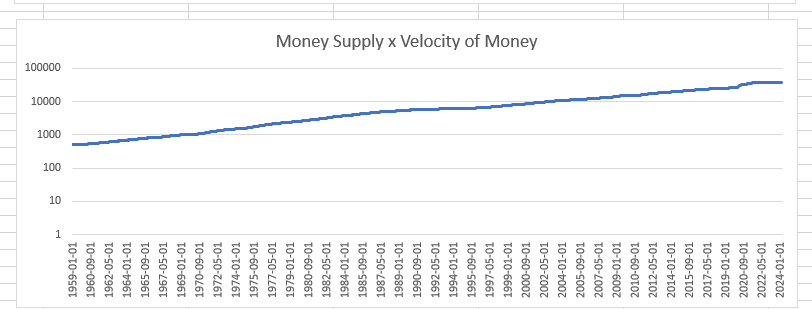

However, when you multiply supply times velocity, you get “this number “inflation” and for whatever reason, govts around the world have tried to use the New Zealand arbitrary model of 2% inflation for steady economic growth since the 1990’s.

The flexibility provided by focusing on the medium term means we can avoid creating large swings in interest rates, output and employment in order to respond to temporary fluctuations in inflation.

New Zealand Central Bank

In the coronavirus recession of 2020, you can see that the velocity of money dropped off a cliff. This is why central banks increased the money supply by a whopping 30%-40%. Without it, the economy could have halted to a stop. Details continue below.

Charts of Money Supply & Velocity of Money

Supply of Money:

Velocity of Money:

What may not be obvious is the slowing of money velocity over the last few decades. People are spending less money.

Inflation = Supply x Velocity:

This chart, which I created, and exists nowhere else to my knowledge in this exact form, gives you the big picture of what central banks/governments have been trying to accomplish for the last century. It uses a logarithmic scale for clarity. Notice during the coronavirus pandemic how inflation remained steady:

Do you see the slow, steady growth? A slow, steady controlled inflation seems like the modern way to keep economies stable and moving forward, perhaps also avoiding the “hoarding of cash” issue that arose during the depression but in economics, there are always unintended consequences to non-market, government-induced behavior.

E.g. Raising the minimum wage, and history shows that the number of low-paying jobs on the market tends to shrink. Unintended consequences of this inflation could be the shift from cash to assets, leading to massive asset bubbles, or an increase in the difference between the very rich and the very poor. Another outcome is that as long as these trends remain predictable, wise investors, companies, and individuals can use them to game the system with large amounts of leverage, again, leading to larger differences in wealth by those who know vs those who don’t. An unpredictable future actually could put everyone on more equal footing in the long run, as long as the poor were taken care of of course.

What are the Consequences of This Standardized Approach?

I have said elsewhere that in the short term, printing to offset short-term velocity of money issues could be a smart move, as it smooths the bumps. But, in the long term, the risk of serious inflation, or systemic collapse is likely. When you realize most of the modern world is playing this group think, it could mean even higher risk than anyone can imagine.

This is what I call smoothing the waves while not being able to change the tide. All that needs to happen is a loss of confidence in the currency before all the dollars are let loose. Either way, the balance between inflation and deflation seems could see increasing levels of volatility at some point.

As interest rates go to zero, and even negative as is the case in many countries like Denmark, Japan, Sweden, Switzerland, and the Eurozone, there is no runway left other than for central banks to resort to even heavier-handed methods to “rescue” economies like investing in the private stock markets (it has been increasingly). Negative interest rates could make sense in a post-crisis (e.g. war) situation, on a limited scale, but in today’s world, the opposite is true. No real crisis and most modern governments are near or below zero. What will happen if a lot more is needed?

Most likely spending is decreasing because the modern world is aging quickly, and fewer people are being born. Technological efficiency, especially in AI and robots, should decrease the real cost of most things in our lives drastically, but as long as scarcity exists, or people believe that need more, then tech will probably not have a big impact on long-term deflation for the foreseeable future.