If gold is skyrocketing, it’s simply a sign that the economic or fiat current systems are failing, therefore, I do not wish gold to do very well. The growth of gold would be a symbol that fiat and dollars are failing, a process which is currently happening slowly around the world, largely visible by global central bank printing presses. Gold therefore is not as an investment, but a hedge from risky govt and central bank actions. If you are not familiar with how the Roman Empire also ended in a debasement of their currency, then take a few minutes from your day to learn more about that.

So, here is the math on valuing gold today, at least if people are to decide that currencies are too risky to hold:

Gold in US central banks (gold reserves) is supposedly 260 M oz, or 16.25 tons. Now, a few have called for an audit of Fort Knox, but let’s assume it’s all there for these calculations.

- If you just count dollars in circulation:

- $2.3 T / 260 M oz = $9k / oz

- If you count all Fed assets:

- $9M / 260 M oz = $34k / oz

- If you count M2, then its:

- $22T / 260M = $80k / oz

- FYI: “The Adjusted Monetary Base is the sum of currency (including coin) in circulation outside Federal Reserve Banks and the U.S. Treasury, plus deposits held by depository institutions at Federal Reserve Banks.”

- $22T / 260M = $80k / oz

- If you compare history of gold to Fed monetary base:

- The low might be 4x current price ($8k/oz) and high would be 10x, or about $20k/oz.

So to say that gold does not have a large potential upside is difficult to argue. All we need is an event to trigger it, like another bank run (e.g. post 1929 stock market crash, or 2008 market crash)

Of course, gold would not return to these high levels as the government will just ban gold again like they did in 1933. Might as well assume they will ban crypto as well if its a perceived threat to the dollar. However, global demand and the increasing ease of moving between countries may still cause gold to rise to new unforeseen heights.

Fort Knox has about 147M oz, or about half of the reserves, and if that was all lent out, or gone, then just double the values here. If the dollar fails, then other currencies could replace it, and determining the value of gold is complex to say the least.

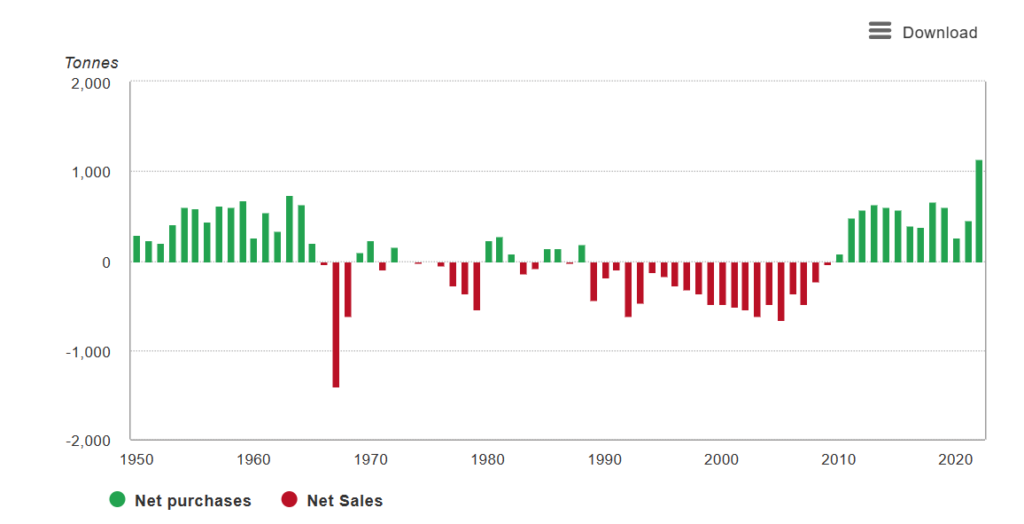

P.S. “Central banks added a whopping 1,136 tonnes of gold worth some $70 billion to their stockpiles in 2022, by far the most of any year in records going back to 1950, the World Gold Council (WGC) said on Tuesday.” – Reuters. Perhaps central banks know their long term printing plan is doomed, but in any case, it would be foolish not to keep an eye on them for the old reason of “do as I say, not as I do”.

On the other hand, I would be even more concerned if net gold purchases didn’t increase over time with increasing size of economies and money printing because in this case, currency debasement would be even higher.

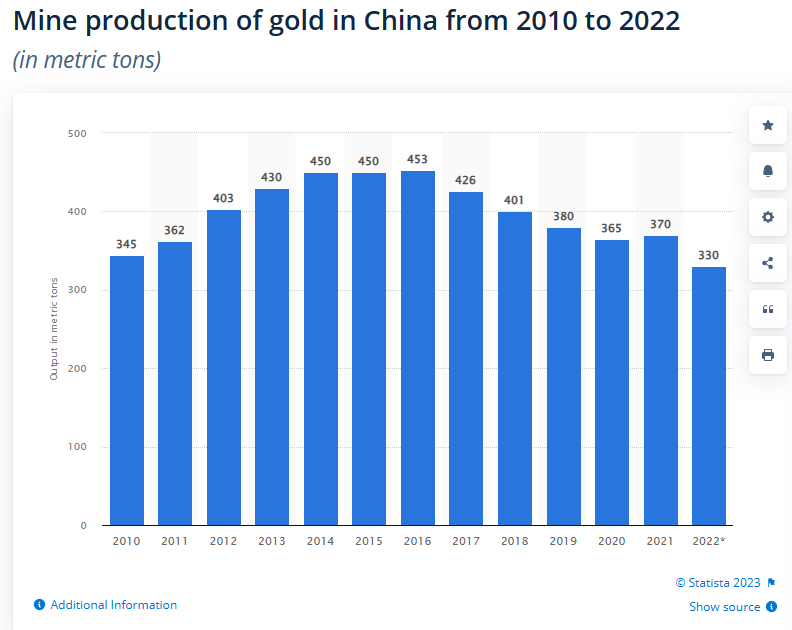

Just some quick final notes on China demonstrating their goal to become the world’s reserve currency. One of the most interesting facts is that while they are the world’s largest producer of gold, they are also not allowed to export it. In the last 10 years alone, they have mined almost 5,000 tons. Assuming the govt buys or owns most of that, that would probably put them ahead of our gold holdings. Then there’s their import rate: In 2022 alone, they imported over 1,300 tons of gold. Finally, there is quite a bit of discussion that China is likely covertly buying gold as to avoid raising eyebrows and tensions. With these factors combined, they could easily have double our gold reserves already, making its Yuan a future candidate for the world’s reserve currency.

In terms of political risks, I expect that when the world breaks down, there will be an increased attempt for some nations to attempt to rob the gold vaults of other nations.

It’s a little known fact that the first thing that Hitler always did when Germany invaded another country in their Blitzkriegs, which was to go empty their central bank’s vault of that nasty, yellow brutish stuff (a.k.a. gold), so when the fiat system falters and gold skyrockets, we can all guess the political implications. Good thing China hides their gold while we make our locations well known.

Then again, if the world is starving, maybe gold will be worthless after all. At least such was true at the local level in parts of Europe in WW2.

P.S. This is entertainment, not investment advice.