So what does it mean if the entire world has stopped growing new consumers and producers?

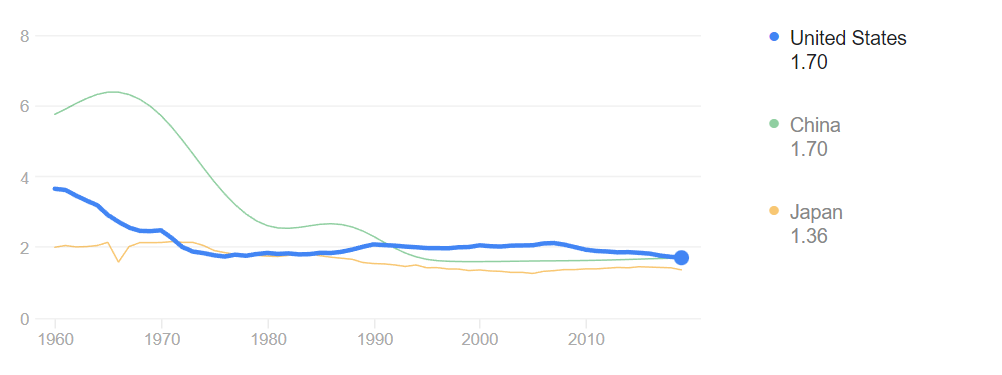

“U.S. growth didn’t slowly fade away: It slipped, and slipped, and then fell off a cliff. The 2010s were already demographically stagnant; every year from 2011 to 2017, the U.S. grew by only 2 million people. In 2020, the U.S. grew by just 1.1 million. Last year, we added only 393,000 people.” – The Atlantic. Immigration has also fallen off by 75% in the US over the last 10 years. Immigration was actually the only thin hold us up because our fertility rates have been below zero since the 1980’s:

China also fell off a cliff in 2021. My math shows that they grew less than 0.1% in 2021, or effectively 0%.

When you realize however, that govt’s around the world set a moderate GDP growth goal which is well above 0% (e.g. China 4%, US 2%-3%), then somehow the math simply does not work out. Japan started experiencing a decrease in total population almost two decades ago, and plenty of other countries are now going negative such as: Latvia, Moldova, Lithuania, Estonia, Bulgaria, Ukraine, Croatia, Serbia, Romania, Greece (all losing above 0.3%) and many other countries

True, 2021 may be an unusually slow year, but most suggest that China will start losing population sometime this decade which I attribute to two factors:

- A low fertility rate: About 1.7% which is far below replacement rate and the Chinese govt cant seem to turn around), usually due to economic success.

- Emigration: Nobody immigrates to China (I checked), and the successful ones often leave. Last I checked, owning real estate in China is not even legal, which is no surprise when you see how much Ghinese invements money is constantly flooding into the USA. *

Sure, technology improvements create some of the GDP growth, but so do people, and government targets likely to be skewed. I think top-down targets are more of a risk than a solution.

So, with such an imbalance, I expect increased financial market distortions as central banks try to achieve such misguided targets

With the Chinese and US being among the largest consumers and producers, this will create some real issues going forward.

This post is a work in progress. Hope to update it with some charts next year and post changes in growth changes.

* A few years ago, a news outlet reported that Chinese investors were responsible for half of all real estate investments in CA. It’s well known that Chinese investments in Canada too are an issue for Canadians. Just yesterday a farmer neighbor told me a Chinese group bought a $100M farm business, through an intermediary Canadian entity they bought after the US would not let them buy directly.