So here we are again: INCOME (GDP) and EXPENSES (national debt)

At no time in history has there been so much debt, not only un-repayable debt

[debt chart last 100 years]

but debt that yields 0 profit for investors

[long term interest rate chart / treasury bonds rates]

“Like a massive star exploding into a supernova, debt is rising at a blistering pace. There is currently more than $230 trillion in global debt—that’s three times the amount of debt the world held during the credit crisis.” – Stephen Scott

As i mentioned before, not only is that rate 0, but it’s actually going negative? So who is foolish enough to lend to the govt, only to have the govt. charge them on interest?

Simple: No civilized, rational citizen. Instead, speculators (professional financial gamblers) and central banks (a.k.a. other govt) from other countries. I’m going to ignore the speculators who buy this stuff, in hopes to turn around and sell it for more later (and not because its a good investment). Instead, let’s discuss central banks for a moment. What do we call it again when the masses inflate a bad investment into a terrible investment? A bubble. We call it, everyone’s drinking the Kool-aid, and that is the sad state of central banks and govt’s around the world.

Question is, who will stop govt. from playing these ponzi schemes with the entire world economies? Is it stoppable? Perhaps, but there would have to be a pretty big mind, or paradigm shift. What could cause a shift in a realization that global govt debt is unsustainable? Here are a few possibilities:

- Awakening of the common sense of the masses: (via education), via social media and blogs like this one

- Massive selling off, or running away from govt debt (e.g. U.S. Treasuries) because well, why would anyone want to hold debt of a country that cant pay its bills?

- A run to alternative investments that are not subject to govt debt and printing presses? problem is, most other assets seem inflated as well?

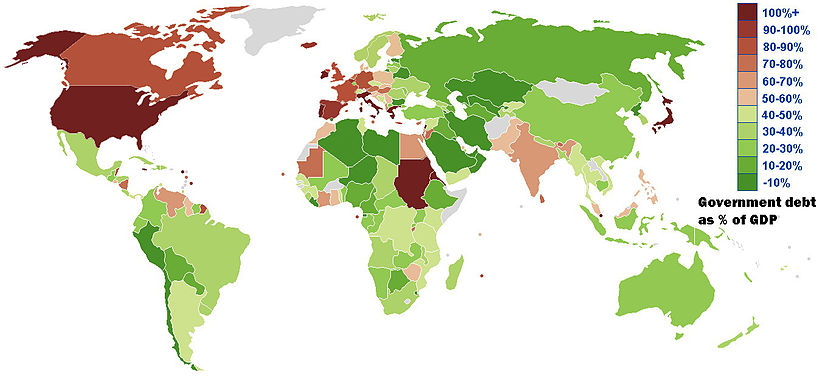

- Leaving 1st world debt behind to invest in countries with low debt and high growth? Remember that chart on my first post about GDP-to-debt of countries around the world?

The real cause of all these problems really amount to two simple facts:

- Increasing debt

- Decreasing income

Well in Pillar #1, I showed how the economy is heading for a big downturn. Once you combine that with debt that is spiraling out of control, at what point do investors begin to dump U.S. Treasuries?

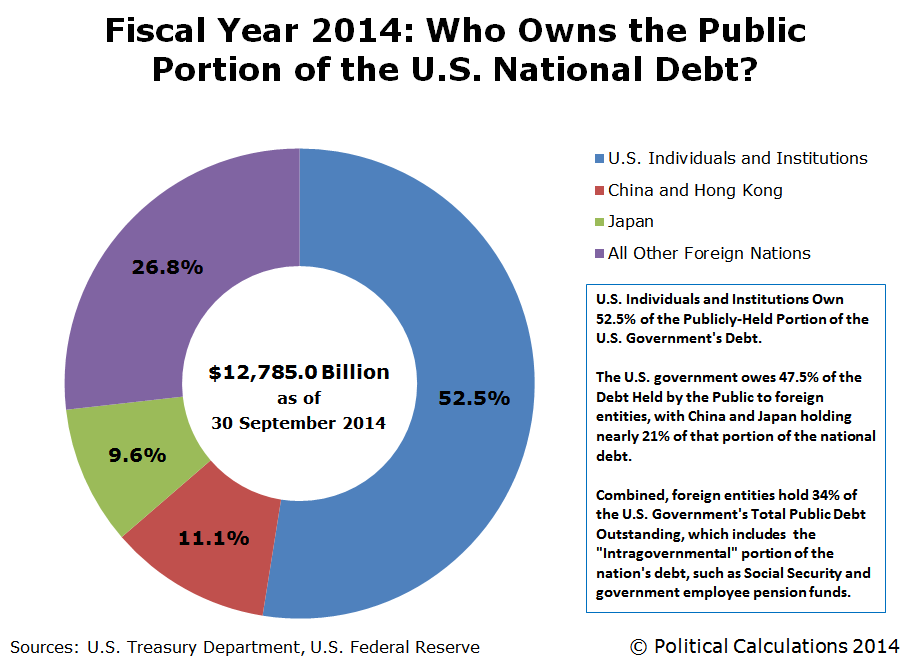

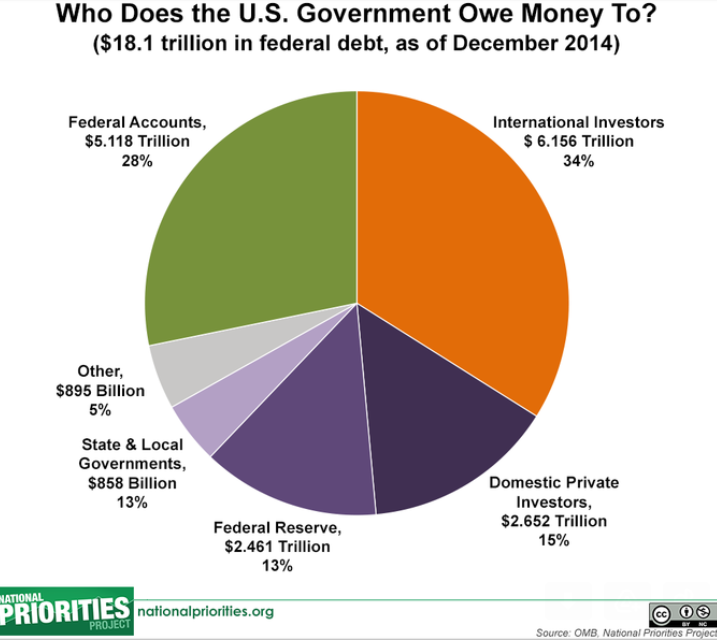

What if I said other countries are already starting to dump them? China, the largest foreign holder of US Treasuries (about 5%), began diversifying away from the dollar. Now, China only owns a few percent of our debt, but for them, it’s a lot. In fact, Americans hold by far most of its own govt’s debt. In fact, the govt itself owns 54% of its own debt. How does that work?

Good luck with all that esp. since coming inflation, fiscally irresponsible govt, growing retirees with growing Medicare/social security expenses, borrowing from other govt funds (25%), a decrease in the working population. The only counter-trend may be robots/AI, but that’s a wildcard too. If interest rates go up, then that’s an even bigger problem. True, inflation may wipe out the debt, but who would want to even invest in Treasuries if you were losing money in real terms? Not I.

A Bit on American Hegemony

I wanted to talk a bit more about US debt, as well as how the US became the “hegemonic” power of the world. This simply means, when a single country is able to get their currency used throughout the world, and as a result, they become the worlds “reserve currency” or they achieve what is called “hegemony.” In short, they become rich. We have held hegemony since post WW2, and complete hegemony is often said to have occurred in 1991 when Russia dropped out of the picture.

Many other countries have held hegemony in the past, usually for a few decades. Russia and China want hegemony now, probably because A. they are tired of us having it, and B. they want to be rich. Typical greed, envy, and power problems you might say.

The sad part is, with our debt being as high as it is, and no plans to reduce it as long as entitlements outpace our income, other countries are being seen less and less as being able to pay back our debt to them.

The odd thing is, since 2008, the housing bubble collapse, when the stock market crashed, the world markets did the most logical thing at the time, which as to invest in something safer than stocks; US Treasuries (bonds). In fact, they doubled their investment to over $6 trillion. That’s right, in a short amount of time, they lent us $6 trillion dollars to spend on whatever we wanted: more social programs, more guns, etc… because US debt is considered the “risk free” or safest investment in the world, so when other countries are having issues, they pile in here. From that you can see how hegemony is just part of a natural cycle in the end, so it’s not like I expect any country to maintain it forever, but slow and steady seems like a safer bet to me.

The tides have already begun to turn against the dollar. And with one more stock market meltdown, do you think that foreigners are going to place their trust in a debt that has exceeded all historical limits? Seems countries are continuing to slowly but surely abandon the dollar.

Or will they say, hey, here’s another country over here (e.g. China or India) with a growing population and economy, and we are going to let them borrow money instead. Now China is a force, but their population may decline. The Dutch proved however you can control a few ports and gain hegemony via a small population in the 1600’s so population ain’t everything, but it tends to have some influence. Even as China loses people, it could gain hegemony on the way down, but lots of unknown variables in that Asian growth story.

Financial people and economists have a hard time accepting this possibility because:

- Normalcy bias: we have held hegemony for so long, but as all nations in the past, hegemony is never permanent, as there always comes a point at which hegemony no longer makes sense

- Even though the loss incurred by switching away from dollars as the world’s reserve currency,much like declaring a loss on a bad creditor, will be high and painful for many countries.

- The shift away from dollars will probably need to be just as united as was the shift towards dollars was united

- They cant imagine that oil will no longer be traded in dollars…and that I am saying is reaching a tipping point as well.

So who do we own money to? the govt debt, or US Treasuries?

Bonds are selling faster than ever. China, America’s largest foreign holder of US debt, for example has dumped 20% of US bonds (and stocks too by the way) since 2014.

“It’s the largest selloff of U.S. debt since at least 1978, according to Treasury Department data.”

Even Japan, Brazil, and Saudi Arabia have begun selling off this year.

This article sums it up well:

“Treasuries are considered one of the safest assets in the world, but some experts say a sense of panic about the global economy drove the selloff. “It’s more of global fear than anything,” says Ihab Salib, head of international fixed income at Federated Investors. “There’s still this fear of ‘everything is going to fall apart.”

Irrational fear? or is the world finally admitting that the plan for many of the world’s central banks to simply print money (quantitative easing) is simply going to end badly, meaning either inability to repay debt, or inflation that will wipe out debt.

Now, in this next stock market crash, we could briefly see the same issue we say in 2008 where people quickly run to treasuries, but at some point, the debt may rise so high that it simply becomes unsustainable and begins to reverse (sell off). Note that Japan has the worst debt now for decades and hasn’t crashed…yet, but chances are it’s going to take some global pressure for something to happen there.

So, back to hegemony for a minute:

What do you get when the entire world stops investing in the US Dollar? or in other words, the world stops buying US debt because they think we can no longer pay it back?

Add in a major depression that I am predicting in PILLAR #1, and you realize that low INCOME , plus high DEBT = a country that is not fit to be the world’s reserve currency. A country that is bankrupt. Either that or mass socialization (communist) approach to rescuing the economy. Similarly, high inflation (maybe even the hyper type) seems to be the only predictable outcome as well based on current trends.

Again, the US is far from being alone in this massive mess. Many countries have high debt-to-GDP and once a global depression/recession hits, then many countries will have financial problems. This debt-to-GDP chart shows how many countries, esp Western, have a huge debt problem. But even Russia and China have all sorts of financial problems, incl quantitative easing. In fact, the only countries that won’t be affected are going to be those that are economically isolated, and not dependent on, the first-world.

So, if hegemony made us rich, then the lack of it might just make our problems even worse. Can you imagine, not only is our economy at a slugs pace, but now we can even borrow money at a reasonable rate? How will we move forward?

Wanna know something really weird? There is one other factor that has maintained our hegemonic power for the last couple of decades, and in PILLAR #3, I will show you it is wars, and how it also has contributed to our bubble, wars which may be contrived in some part.

The Real Secret and Reason We are About to Lose Hegemony:

The real cause of loss of hegemony would simply to be for all countries, esp. oil selling countries then, to stop accepting dollars, or trading in other currencies. Unlikely you think? Well, we have been fighting wars to prevent this over the last couple of decades, which is what PILLAR #3 will show.

The problem is, we are out of aces…

P.S. The reason helicopter money, or quantitative easing does not work IMO is this. You cant lead a horse to water, but you can stop him from getting to water. Back in the 1930’s the govt actually CAUSED the depression because they retracted/contracted the money supply, or stopped spending, which caused deleveraging faster, so the thought today is if govt does the opposite, it will cause the economy to grow. Problem is, while you can take money away from an economy, you cant force it in, or you cant force people to spend. Since QE, the money is not being spent/used. It’s been declining, at least for now. Perhaps all those dollars will suddenly escape, leading to inflation instead of depression. Either way, the future, based on today’s behavior, is very clear.