Because if you and I don’t reform it, we will all be working for the federal government in the near future.

There are lots of numbers to consider when looking at a potentially lopsided govt, but all of them seem to fall short in my mind. Even debt-to-GDP is simply a long-term accumulation of a shorter term pattern of spending; and not in total numbers since:

- inflation makes the growth in spending difficult to decipher.

- Is too late of a signal as it shows the long term accumulation of an immediate, short term trend

- It also doesn’t clearly show the ratio of day-to-day burden the govt places on the backs of its own producers (its working citizens).

- It’s not the underlying cause of the problem and therefore cannot be addressed directly

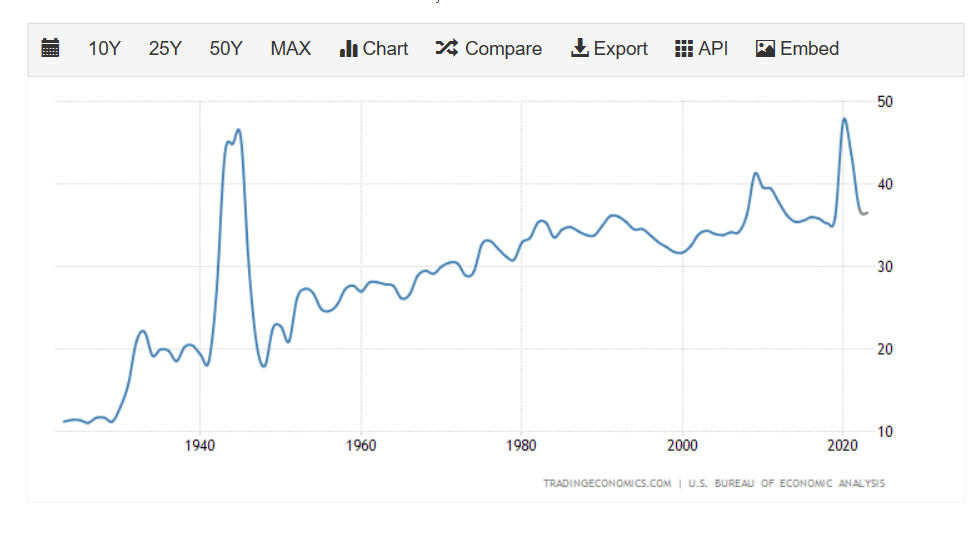

You can see from the below that govt spending almost reached half of GDP. The problem is worsening with time.

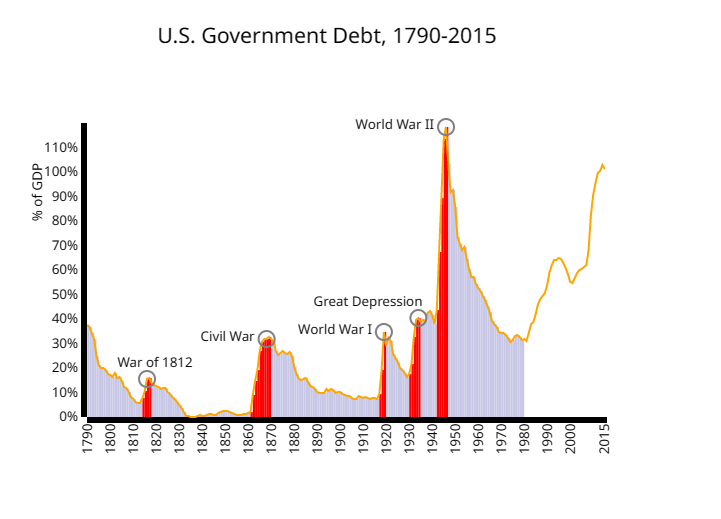

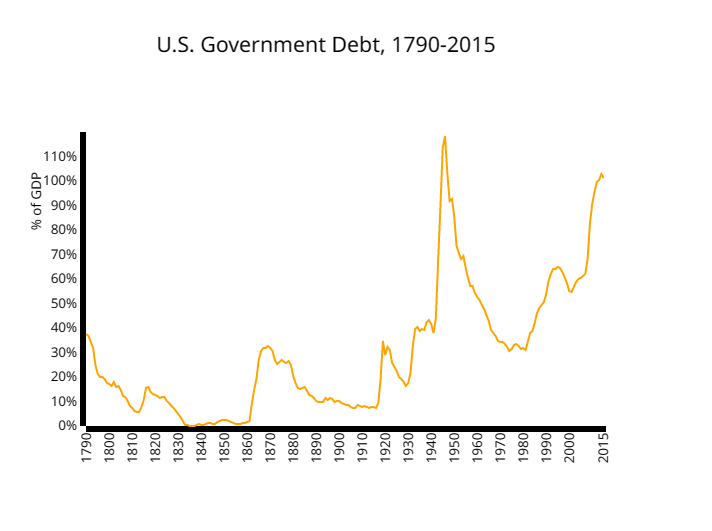

Obviously, WW2 explains the jump in the 1940’s but why the slow increase since then? Here’s a 100 year chart showing the impacts of wars and the Great Depression on debt-to-GDP:

That question deserves a book or two, but it is interesting to note the larger than normal declines in the late 90’s (Bill Clinton 1993-2001), but followed by a larger peak, and then that repeats. Under George W. Bush, it tends to lie flat until the 2008 housing crisis. Under Obama it trends down again after the crisis abates, and then spikes during the coronavirus of 2020.

Govt. Debt to GDP: 200 Years

Because there does not seem to be a lot of data on debt Up until the mid-20th century, the US averaged a 3% debt-to-GDP. Since then, it’s skyrocketed. Are we at a peak, or just the start of a massive new spike?

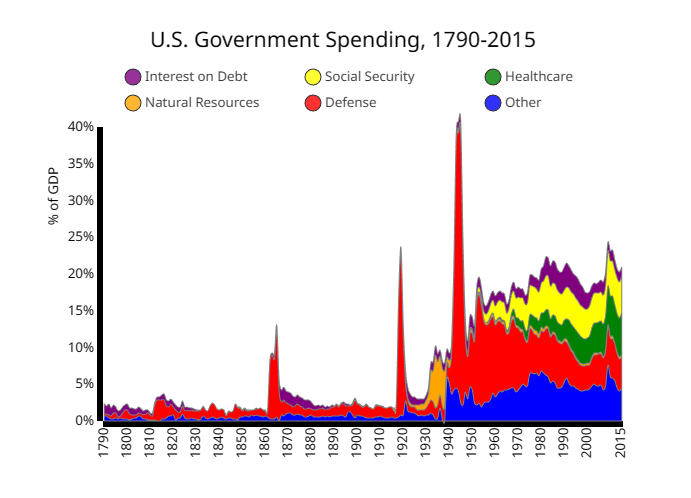

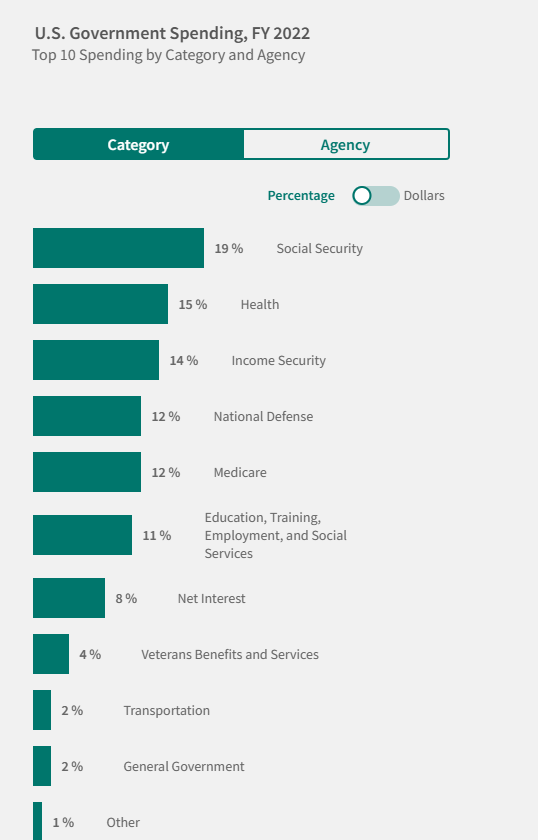

The items that stand out are social security and healthcare. Just because defense is dropping as a % of total, does not mean it’s dropping as a % of total GDP spending over time. This only shows relative spending within all budgets:

The Future Growth in Spending is Clearly Worse

Given that Social Security is the largest spending, that is likely due to people getting older, however, considering the govt. themselves have admitted the trust funds will run out within a decade, this can only mean more taxes. With fertility rates at their lowest ever, there does not seem to be a reversal in the near future, but more importantly we learn that we cannot trust the govt to invest for our retirement. I think most of us already suspected this decades ago as young adults. This is even more true as the ratio of retirement age to working (or at least productive working) age increases.

If you want a successful care-for-the-elderly model, you should probably look at the Amish who opted out of social security a long time ago, are generally more careful with money than the rest of us, and take care of their elderly, probably large in part because it’s such a personal, geographically close, community, upheld by high moral values.

But why would taking care of the elderly be getting more expensive? Medicine can be a double-edged sword because measuring the effects of keeping people alive longer is difficult to disentangle. On the other hand, there are areas that clearly show an increase in consumption, meaning we just continue to slowly dig our own graves. What is the logical trend to look at then to test this idea? Simple, the single most expensive portion of anyone’s budget: housing.

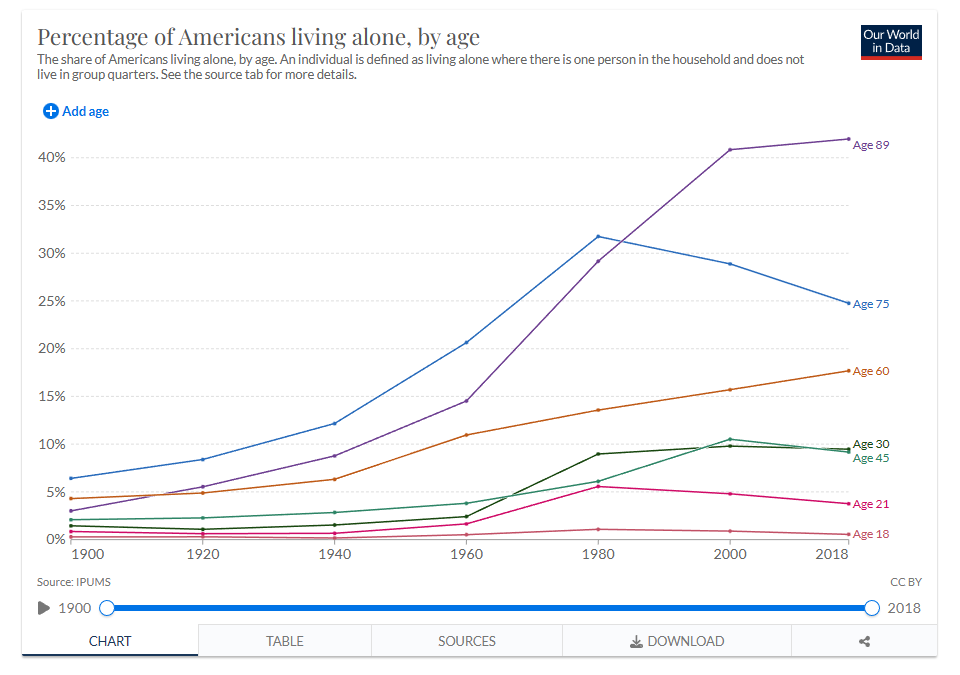

When you look at housing trends for example over 100 years, there is a clue that one of the main reasons it’s more expensive as an elderly person is because it appears that more and more of them are living alone, meaning, in their own housing:

Again, the Amish probably follow methods that are still common in most of the world which is to have several generations of family living under the same roof. This is true for probably most of the not-so-rich world today.

Why Technology, Robots/AI, and Lifespans May Increase Debt

When robots/AI pickup steam, this could increase productivity to the moon as labor and thought are commoditized. As a result, debt might climb significantly because, as I have theorized previously, some of this debt increase may simply be due to an increase in average lifespans (as people can wait longer to get repaid). As tech starts to slow and reverse aging, the repayment of debt could be near infinite, causing a near infinite debt limit increase. I also wonder if deflationary pressures from tech will eventually commoditize every aspect of living in the way information tech has made learning cheaper than ever over the last few decades. But 3-D printing everything from medicine to electronics out of toilet waste, C02, and grass from our yard is probably still a ways off.

This is clearly a complex and perhaps indecipherable puzzle for now.

Other Possible Outcomes: The US Becomes A Failed Nation

Besides us all working for the govt (in Argentina 55% of the population currently works for the govt), the other major risk is loss of income, global crisis’, loss of hegemony. Regardless, a loss in trust in creditworthiness, followed by printing and inflation, followed by political chaos, seem likely. Yet, all of this could be avoided with a handful of behavior changes from both the population and govt.

Quite a few people even believe that Asia is on some future course to become the leader of the world again, as was the case centuries ago, but for now, things like a declining population and shortage of ideological freedom reduce that likelihood significantly.

The govt does not have a high incentive currently to reduce spending, which is why it is up to the common people to enact a major overhaul of the govt system.

Potential Solutions

Perhaps a constitutional amendment, or a balance of financial powers between govt and population is needed. That is, the citizens more directly control the budgets, not the people in office. Other solutions would be to have contractual agreements over certain areas such as spending/unbreakable-budgets before a candidate could enter office, thereby reducing the risk of empty promises by candidates. In any case, the people need to become controllers, but even then, I am not sure why most people would agree to spending less, and being frugal, since that is not in the minds of most modern Americans IMO.

For the population, we would be better off looking for solutions that eliminate the govt increasing heavy handed involvement in our daily lives, starting with taking care of our seniors. Another major issue is considering that medical costs tend to be the fastest growing costs over time, increased efforts to increase competition (like eliminating the growing hospital monopolies) should drive down costs over time.

The most likely short term outcome however is war, because people don’t usually reform themselves voluntarily, citizens and govt alike. Materialism is comfortable too. Seriously, I tell people they should have their parents live with them to save money and then the eyeballs start rolling.